SOUTH KOREA FLEXIBLE THIN FILM AND PRINTED BATTERY MARKET FORECAST 2025-2032

South Korea Flexible Thin Film and Printed Battery Market by Chargeability (Rechargeable, Non-Rechargeable), Market by Capacity (Below 10 MAH, 10-100 MAH, Above 100 MAH), Market by Material (Lithium-Ion, Zinc-Based, Nickel-Metal Hydride, Solid-State Electrolytes, Polymer Electrolytes, Aqueous Electrolytes), Market by Form Factor/Shape (Curved, Rollable, Stretchable, Conformal, Micro-Battery Configurations), Market by End-User Industry (Consumer Electronics, Healthcare & Medical, Smart Packaging, Automotive & Transportation, Industrial & Manufacturing, Logistics & Supply Chain, Military & Defense, Retail, Other End-User Industries), Market by Sales Channel (Direct Sales (OEM Supply), Distributors & Wholesalers, Online Channels, Specialty Retailers), by Geography

韓国のフレキシブル薄膜およびプリンテッドバッテリー市場:充電性(充電式、非充電式)、容量(10MAH未満、10~100MAH、100MAH超)、材質(リチウムイオン、亜鉛系、ニッケル水素、固体電解質、ポリマー電解質、水性電解質)、フォームファクター/形状(湾曲型、巻き取り型、伸縮型、コンフォーマル型、マイクロバッテリー構成)、エンドユーザー産業(民生用電子機器、ヘルスケア・医療、スマートパッケージング、自動車・輸送、工業・製造、物流・サプライチェーン、軍事・防衛、小売、その他のエンドユーザー産業)、販売チャネル(直接販売(OEM供給)、販売代理店・卸売業者、オンラインチャネル、専門小売業者)、地域別

| 出版 | Inkwood Research |

| 出版年月 | 2026年01月 |

| ページ数 | 160 |

| 価格 | 記載以外のライセンスについてはお問合せください。 |

| シングルユーザ | USD 1,100 |

| 企業ライセンス | USD 1,500 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-11232 |

| タイトル | Single User Price (USD) | |

| 世界のフレキシブル薄膜電池と印刷電池市場予測 2025-2032年 | GLOBAL FLEXIBLE THIN FILM AND PRINTED BATTERY MARKET FORECAST 2025-2032 | USD 2,900 |

韓国のフレキシブル薄膜およびプリンテッドバッテリー市場規模は、2025年時点で1億5,752万ドルと評価されており、2025年から2032年の予測期間中に20.97%のCAGRで成長し、2032年には5億9,719万ドルに達すると予想されています。

韓国のフレキシブル薄膜電池およびプリンテッド電池市場は、小型で柔軟性の高い電源を必要とする小型ウェアラブル端末や健康モニタリング機器の需要急増を主な原動力として、堅調な成長を遂げています。この需要は、韓国がコンシューマーエレクトロニクス分野をリードしていることに起因しており、企業はこれらの電池をスマートウォッチやフィットネストラッカーに搭載することで、ユーザーの快適性を向上させています。

さらに、京畿道などの電子機器クラスターを含む韓国の高度な製造エコシステムは、迅速な試作と生産規模の拡大を可能にしています。活発な特許活動と材料研究への投資は、エネルギー密度の向上や柔軟性の向上といった性能向上をさらに加速させています。

セグメンテーション分析

韓国のフレキシブル薄膜およびプリンテッドバッテリー市場は、充電性、容量、材料、フォームファクター/形状、エンドユーザー産業、および販売チャネルによってセグメント化されています。容量セグメントはさらに、10mAh未満、10~100mAh、100mAh超に分類されます。

容量セグメントは、韓国のフレキシブル薄膜およびプリンテッドバッテリー市場を形成する上で極めて重要な役割を果たしており、10mAh未満のサブセグメントは2032年まで急速に拡大する分野として浮上しています。この急成長は、スマートパッチ、化粧品デバイス、RFIDタグ、使い捨て医療センサーなどの超薄型アプリケーションに最適であることから生じており、スペースの制約により、信頼性の高い電力供給を維持しながら最小限の設置面積が求められます。

家電OEMやヘルスケア企業からの旺盛な国内需要が、これらのマイクロスケールバッテリーのコスト効率の高い大量生産を可能にする国内のロールツーロール印刷能力に支えられ、採用を加速させています。最大の収益性を求めるベンダーは、ウェアラブル大手や医療機器メーカーとの契約獲得に向けて、10mAh未満のセル、特に生体適合性と皮膚安全性を備えたセル向けに最適化されたインク配合を優先すべきです。

一方、10~100mAhおよび100mAh超のサブセグメントは、高度なフィットネストラッカー、ヒアラブルデバイス、新興の折りたたみ式デバイスなど、より電力を消費しながらも柔軟性を維持した用途に対応しています。このセグメントの成長率は10mAh未満のカテゴリに比べて低いものの、単価の上昇と韓国の製造拠点からの輸出受注の拡大により、絶対的な収益ポテンシャルは依然として大きくなっています。

韓国試験研究院(KTL)と産業通商資源部の規制要件により、メーカーは認証取得済みの高容量設計へと移行しており、安全性検証とサイクル寿命試験に早期に投資するプレーヤーは明確な優位性を得られます。投資家とベンダーは、まず10mAh未満の容量領域でのパートナーシップに注力して迅速な市場参入を図り、その後、実績のあるプラットフォームを10~100mAhの範囲に拡張することで、次世代ウェアラブルやスマートシティのセンサーネットワークに対応し、ビジネスチャンスを最大化できます。

KEY FINDINGS

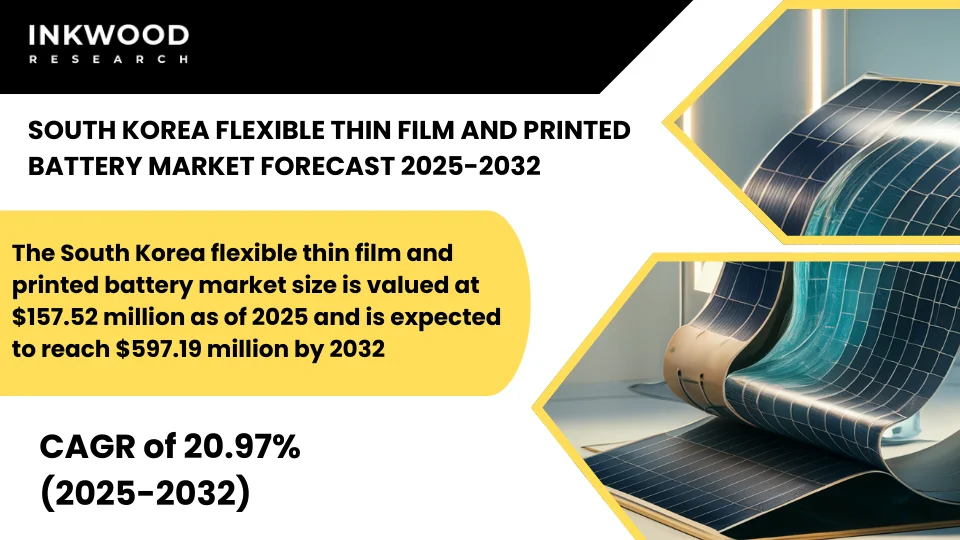

The South Korea flexible thin film and printed battery market size is valued at $157.52 million as of 2025 and is expected to reach $597.19 million by 2032, progressing with a CAGR of 20.97% during the forecast period, 2025-2032.

SOUTH-KOREA-FLEXIBLE-THIN-FILM-AND-PRINTED-BATTERY-MARKET-FORECAST-2025-2032

MARKET INSIGHTS

The South Korea flexible thin film and printed battery market is experiencing robust growth, primarily driven by surging demand for miniaturized wearables and health monitoring devices, which require compact and adaptable power sources. This demand stems from the country’s leadership in consumer electronics, where companies integrate these batteries into smartwatches and fitness trackers for improved user comfort.

Additionally, South Korea’s advanced manufacturing ecosystem, including electronics clusters in regions like Gyeonggi Province, enables rapid prototyping and scaling of production. Strong patent activity and investments in materials research further accelerate performance enhancements, such as higher energy density and flexibility.

Government incentives, including subsidies under the Green New Deal and Innovation Programs, reduce commercialization risks by funding R&D in eco-friendly electronics. These policies promote sustainable battery technologies, lowering barriers to entry for startups while encouraging large conglomerates to invest. For vendors, the biggest opportunities lie in partnering with OEMs for co-development, while investors should focus on firms advancing biocompatible inks for medical applications to capitalize on export potential to APAC markets.

The South Korea flexible thin film and printed battery market expansion reflects the nation’s strong domestic supply chains for advanced materials, which speed up pilots and early commercialization. Moreover, collaborations between universities and conglomerates drive R&D into high-performance flexible cells, addressing needs in Industry 4.0 and smart city initiatives.

Regulations like strict safety standards under the Electrical Appliances and Consumer Products Safety Control Act require lengthy certifications, shaping demand by ensuring reliability but creating entry barriers for new players. Key trends include rising co-development between startups and electronics manufacturers, which fosters innovation in biocompatible inks for health applications. Local pilot lines support fast iteration, reducing time-to-market.

However, restraints such as dominance of traditional lithium-ion chains pose price competition, and limited long-term data on cycle life hinders medical adoption. To overcome these, vendors should invest in field testing, and investors can target niches like smart packaging, where small domestic markets limit volume but offer high margins through policy-driven smart city pilots.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2025-2032 |

| Base Year | 2024 |

| Market Historical Years | 2018-2023 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Chargeability, Capacity, Form Factor/Shape, End-User Industry, Sales Channel, and Material |

| Country Analyzed | South Korea |

| Companies Analyzed | Panasonic Corporation, Samsung SDI, LG Chem Ltd, Jenax Inc, SK Innovation Co Ltd, POSCO Chemical Co Ltd |

SEGMENTATION ANALYSIS

The South Korea flexible thin film and printed battery market is segmented into chargeability, capacity, material, form factor/shape, end-user industry, and sales channel. The capacity segment is further categorized into below 10 mAh, 10-100 mAh, and above 100 mAh.

The capacity segment plays a pivotal role in shaping the South Korea flexible thin film and printed battery market, with the below 10 mAh sub-segment emerging as a rapidly-expanding area through 2032. This surge stems from its ideal fit for ultra-thin applications such as smart patches, cosmetic devices, RFID tags, and disposable medical sensors, where space constraints demand minimal footprint while maintaining reliable power delivery.

Strong domestic demand from consumer electronics OEMs and healthcare firms accelerates adoption, supported by local roll-to-roll printing capabilities that enable cost-effective, high-volume production of these micro-scale batteries. Vendors seeking the strongest returns should prioritize ink formulations optimized for below 10 mAh cells, particularly biocompatible and skin-safe variants, to capture contracts with wearable giants and medical device makers.

Meanwhile, the 10–100 mAh and above 100 mAh sub-segments cater to more power-intensive yet still flexible uses, including advanced fitness trackers, hearables, and emerging foldable devices. Although growth here trails the below 10 mAh category in percentage terms, absolute revenue potential remains significant due to higher per-unit pricing and expanding export orders from South Korea’s manufacturing hubs.

Regulatory requirements under the Korea Testing Laboratory (KTL) and the Ministry of Trade, Industry, and Energy push manufacturers toward certified higher-capacity designs, creating a clear advantage for players who invest early in safety validation and cycle-life testing. Investors and vendors can maximize opportunity by focusing partnerships on the below 10 mAh space first for quick market entry, then scaling proven platforms into the 10–100 mAh range to serve next-generation wearables and smart-city sensor networks.

COMPETITIVE INSIGHTS

Some of the top players operating in the South Korea flexible thin film and printed battery market include Samsung SDI, LG Chem Ltd, SK Innovation Co Ltd, Jenax Inc, etc.

Samsung SDI is a leading South Korean company specializing in energy solutions and electronic materials, with its primary industry focused on advanced battery manufacturing. Headquartered in Yongin, South Korea, it operates globally across Asia, Europe, and North America, leveraging direct OEM supply channels and partnerships for market reach. Its main product lines relevant to the flexible thin film and printed battery market include lithium-ion and solid-state batteries designed for wearables and IoT devices.

Key examples include flexible cells for smartwatches that offer high energy density and bendability. A distinctive feature of its business model is heavy investment in R&D through collaborations with conglomerates, enabling rapid innovation in eco-friendly, high-performance solutions that align with government green incentives. This positions Samsung SDI as a strategic powerhouse, driving market adoption through scalable production and certified safety standards.

COMPANY PROFILES

- PANASONIC CORPORATION

- SAMSUNG SDI

- LG CHEM LTD

- JENAX INC

- SK INNOVATION CO LTD

- POSCO CHEMICAL CO LTD

TABLE OF CONTENTS

- RESEARCH SCOPE & METHODOLOGY

1.1. STUDY OBJECTIVES

1.2. METHODOLOGY

1.3. ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

2.1. MARKET SIZE & FORECAST

2.2. MARKET OVERVIEW

2.3. SCOPE OF STUDY

2.4. CRISIS SCENARIO ANALYSIS

2.5. MAJOR MARKET FINDINGS

2.5.1. SOUTH KOREA IS SEEING RAPID INTEREST FROM CONSUMER ELECTRONICS OEMS SEEKING FLEXIBLE POWER SOURCES FOR NEXT GENERATION WEARABLES

2.5.2. STRONG DOMESTIC SUPPLY CHAINS FOR ADVANCED MATERIALS ARE ACCELERATING PILOTS AND EARLY COMMERCIALIZATION OF PRINTED BATTERIES

2.5.3. GOVERNMENT SUPPORT FOR INDUSTRY 4.0 AND SMART CITY PILOTS IS CREATING DEMAND SIGNALS FOR PRINTED ENERGY SOLUTIONS

2.5.4. COLLABORATIONS BETWEEN UNIVERSITIES AND LARGE CONGLOMERATES ARE DRIVING COMMERCIAL R&D INTO HIGH-PERFORMANCE FLEXIBLE CELLS

- MARKET DYNAMICS

3.1. KEY DRIVERS

3.1.1. HIGH LOCAL DEMAND FOR MINIATURIZED WEARABLES AND HEALTH MONITORING DEVICES IS BOOSTING MARKET OPPORTUNITIES

3.1.2. ADVANCED MANUFACTURING ECOSYSTEM AND ELECTRONICS CLUSTERS FACILITATE RAPID PROTOTYPING AND SCALEUP

3.1.3. STRONG PATENT ACTIVITY AND INVESTMENT IN MATERIALS R AND D ARE ACCELERATING PERFORMANCE IMPROVEMENTS

3.1.4. GOVERNMENT INCENTIVES FOR GREEN ELECTRONICS AND INNOVATION PROGRAMS ARE LOWERING COMMERCIALIZATION RISK

3.2. KEY RESTRAINTS

3.2.1. STRICT SAFETY AND ELECTRICAL STANDARDS REQUIRE LENGTHY CERTIFICATION PROCESSES FOR NEW BATTERY FORM FACTORS

3.2.2. DOMINANCE OF ESTABLISHED LITHIUM ION SUPPLY CHAINS CREATES PRICE COMPETITION AGAINST FLEXIBLE SOLUTIONS

3.2.3. SMALL DOMESTIC MARKET FOR CERTAIN APPLICATIONS LIMITS LARGE VOLUME DEMAND NEEDED FOR RAPID SCALEUP

3.2.4. LIMITED LONG-TERM FIELD DATA ON CYCLE LIFE HINDERS ADOPTION IN MEDICAL GRADE USE CASES

- KEY ANALYTICS

4.1. KEY MARKET TRENDS

4.1.1. INCREASING CO-DEVELOPMENT BETWEEN BATTERY STARTUPS AND LARGE ELECTRONICS MANUFACTURERS IS BECOMING COMMONPLACE

4.1.2. FOCUS ON BIOCOMPATIBLE AND MEDICAL GRADE INKS IS RISING DUE TO HEALTH MONITORING APPLICATIONS

4.1.3. LOCAL ROLL TO ROLL PILOT LINES ARE BEING ESTABLISHED TO SUPPORT FAST ITERATION CYCLES

4.1.4. EXPORT ORIENTED PLAYERS ARE TARGETING APAC MARKETS FROM SOUTH KOREAN MANUFACTURING HUBS

4.2. PORTER’S FIVE FORCES ANALYSIS

4.2.1. BUYERS POWER

4.2.2. SUPPLIERS POWER

4.2.3. SUBSTITUTION

4.2.4. NEW ENTRANTS

4.2.5. INDUSTRY RIVALRY

4.3. GROWTH PROSPECT MAPPING

4.3.1. GROWTH PROSPECT MAPPING FOR SOUTH KOREA

4.4. MARKET MATURITY ANALYSIS

4.5. MARKET CONCENTRATION ANALYSIS

4.6. VALUE CHAIN ANALYSIS

4.6.1. MATERIALS SUPPLIERS

4.6.2. CONDUCTIVE INK MAKERS

4.6.3. SUBSTRATE PRODUCERS

4.6.4. CELL DESIGN ENGINEERS

4.6.5. ROLL TO ROLL FABRICATORS

4.6.6. MODULE INTEGRATORS

4.6.7. OEM ASSEMBLERS

4.6.8. AFTERMARKET SERVICE

4.7. KEY BUYING CRITERIA

4.7.1. ENERGY DENSITY PER AREA

4.7.2. FLEXIBILITY RATING

4.7.3. CYCLE LIFE PERFORMANCE

4.7.4. CERTIFIED SAFETY

4.8. REGULATORY FRAMEWORK

- FLEXIBLE THIN FILM AND PRINTED BATTERY MARKET BY CHARGEABILITY

5.1. RECHARGEABLE

5.1.1. MARKET FORECAST FIGURE

5.1.2. SEGMENT ANALYSIS

5.2. NON-RECHARGEABLE

5.2.1. MARKET FORECAST FIGURE

5.2.2. SEGMENT ANALYSIS

- FLEXIBLE THIN FILM AND PRINTED BATTERY MARKET BY CAPACITY

6.1. BELOW 10 MAH

6.1.1. MARKET FORECAST FIGURE

6.1.2. SEGMENT ANALYSIS

6.2. 10-100 MAH

6.2.1. MARKET FORECAST FIGURE

6.2.2. SEGMENT ANALYSIS

6.3. ABOVE 100 MAH

6.3.1. MARKET FORECAST FIGURE

6.3.2. SEGMENT ANALYSIS

- FLEXIBLE THIN FILM AND PRINTED BATTERY MARKET BY MATERIAL

7.1. LITHIUM-ION

7.1.1. MARKET FORECAST FIGURE

7.1.2. SEGMENT ANALYSIS

7.2. ZINC-BASED

7.2.1. MARKET FORECAST FIGURE

7.2.2. SEGMENT ANALYSIS

7.3. NICKEL-METAL HYDRIDE

7.3.1. MARKET FORECAST FIGURE

7.3.2. SEGMENT ANALYSIS

7.4. SOLID-STATE ELECTROLYTES

7.4.1. MARKET FORECAST FIGURE

7.4.2. SEGMENT ANALYSIS

7.5. POLYMER ELECTROLYTES

7.5.1. MARKET FORECAST FIGURE

7.5.2. SEGMENT ANALYSIS

7.6. AQUEOUS ELECTROLYTES

7.6.1. MARKET FORECAST FIGURE

7.6.2. SEGMENT ANALYSIS

- FLEXIBLE THIN FILM AND PRINTED BATTERY MARKET BY FORM FACTOR/SHAPE

8.1. CURVED

8.1.1. MARKET FORECAST FIGURE

8.1.2. SEGMENT ANALYSIS

8.2. ROLLABLE

8.2.1. MARKET FORECAST FIGURE

8.2.2. SEGMENT ANALYSIS

8.3. STRETCHABLE

8.3.1. MARKET FORECAST FIGURE

8.3.2. SEGMENT ANALYSIS

8.4. CONFORMAL

8.4.1. MARKET FORECAST FIGURE

8.4.2. SEGMENT ANALYSIS

8.5. MICRO-BATTERY CONFIGURATIONS

8.5.1. MARKET FORECAST FIGURE

8.5.2. SEGMENT ANALYSIS

- FLEXIBLE THIN FILM AND PRINTED BATTERY MARKET BY END-USER INDUSTRY

9.1. CONSUMER ELECTRONICS

9.1.1. MARKET FORECAST FIGURE

9.1.2. SEGMENT ANALYSIS

9.2. HEALTHCARE & MEDICAL

9.2.1. MARKET FORECAST FIGURE

9.2.2. SEGMENT ANALYSIS

9.3. SMART PACKAGING

9.3.1. MARKET FORECAST FIGURE

9.3.2. SEGMENT ANALYSIS

9.4. AUTOMOTIVE & TRANSPORTATION

9.4.1. MARKET FORECAST FIGURE

9.4.2. SEGMENT ANALYSIS

9.5. INDUSTRIAL & MANUFACTURING

9.5.1. MARKET FORECAST FIGURE

9.5.2. SEGMENT ANALYSIS

9.6. LOGISTICS & SUPPLY CHAIN

9.6.1. MARKET FORECAST FIGURE

9.6.2. SEGMENT ANALYSIS

9.7. MILITARY & DEFENSE

9.7.1. MARKET FORECAST FIGURE

9.7.2. SEGMENT ANALYSIS

9.8. RETAIL

9.8.1. MARKET FORECAST FIGURE

9.8.2. SEGMENT ANALYSIS

9.9. OTHER END-USER INDUSTRIES (RESEARCH & ACADEMIA, AEROSPACE)

9.9.1. MARKET FORECAST FIGURE

9.9.2. SEGMENT ANALYSIS

- FLEXIBLE THIN FILM AND PRINTED BATTERY MARKET BY SALES CHANNEL

10.1. DIRECT SALES (OEM SUPPLY)

10.1.1. MARKET FORECAST FIGURE

10.1.2. SEGMENT ANALYSIS

10.2. DISTRIBUTORS & WHOLESALERS

10.2.1. MARKET FORECAST FIGURE

10.2.2. SEGMENT ANALYSIS

10.3. ONLINE CHANNELS

10.3.1. MARKET FORECAST FIGURE

10.3.2. SEGMENT ANALYSIS

10.4. SPECIALTY RETAILERS

10.4.1. MARKET FORECAST FIGURE

10.4.2. SEGMENT ANALYSIS

- COMPETITIVE LANDSCAPE

11.1. KEY STRATEGIC DEVELOPMENTS

11.1.1. MERGERS & ACQUISITIONS

11.1.2. PRODUCT LAUNCHES & DEVELOPMENTS

11.1.3. PARTNERSHIPS & AGREEMENTS

11.1.4. BUSINESS EXPANSIONS & DIVESTITURES

11.2. COMPANY PROFILES

11.2.1. PANASONIC CORPORATION

11.2.1.1. COMPANY OVERVIEW

11.2.1.2. PRODUCTS

11.2.1.3. STRENGTHS & CHALLENGES

11.2.2. SAMSUNG SDI

11.2.2.1. COMPANY OVERVIEW

11.2.2.2. PRODUCTS

11.2.2.3. STRENGTHS & CHALLENGES

11.2.3. LG CHEM LTD

11.2.3.1. COMPANY OVERVIEW

11.2.3.2. PRODUCTS

11.2.3.3. STRENGTHS & CHALLENGES

11.2.4. JENAX INC

11.2.4.1. COMPANY OVERVIEW

11.2.4.2. PRODUCTS

11.2.4.3. STRENGTHS & CHALLENGES

11.2.5. SK INNOVATION CO LTD

11.2.5.1. COMPANY OVERVIEW

11.2.5.2. PRODUCTS

11.2.5.3. STRENGTHS & CHALLENGES

11.2.6. POSCO CHEMICAL CO LTD

11.2.6.1. COMPANY OVERVIEW

11.2.6.2. PRODUCTS

11.2.6.3. STRENGTHS & CHALLENGES

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – FLEXIBLE THIN FILM AND PRINTED BATTERY

TABLE 2: MARKET BY CHARGEABILITY, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 3: MARKET BY CHARGEABILITY, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 4: MARKET BY CAPACITY, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 5: MARKET BY CAPACITY, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 6: MARKET BY MATERIAL, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 7: MARKET BY MATERIAL, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 8: MARKET BY FORM FACTOR/SHAPE, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 9: MARKET BY FORM FACTOR/SHAPE, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 10: MARKET BY END-USER INDUSTRY, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 11: MARKET BY END-USER INDUSTRY, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 12: MARKET BY SALES CHANNEL, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 13: MARKET BY SALES CHANNEL, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 14: KEY PLAYERS OPERATING IN THE SOUTH KOREAN MARKET

TABLE 15: LIST OF MERGERS & ACQUISITIONS

TABLE 16: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 17: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 18: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR SOUTH KOREA

FIGURE 4: MARKET MATURITY ANALYSIS

FIGURE 5: MARKET CONCENTRATION ANALYSIS

FIGURE 6: VALUE CHAIN ANALYSIS

FIGURE 7: KEY BUYING CRITERIA

FIGURE 8: SEGMENT GROWTH POTENTIAL, BY CHARGEABILITY, IN 2024

FIGURE 9: RECHARGEABLE MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 10: NON-RECHARGEABLE MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 11: SEGMENT GROWTH POTENTIAL, BY CAPACITY, IN 2024

FIGURE 12: BELOW 10 MAH MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 13: 10-100 MAH MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 14: ABOVE 100 MAH MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 15: SEGMENT GROWTH POTENTIAL, BY MATERIAL, IN 2024

FIGURE 16: LITHIUM-ION MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 17: ZINC-BASED MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 18: NICKEL-METAL HYDRIDE MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 19: SOLID-STATE ELECTROLYTES MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 20: POLYMER ELECTROLYTES MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 21: AQUEOUS ELECTROLYTES MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 22: SEGMENT GROWTH POTENTIAL, BY FORM FACTOR/SHAPE, IN 2024

FIGURE 23: CURVED MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 24: ROLLABLE MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 25: STRETCHABLE MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 26: CONFORMAL MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 27: MICRO-BATTERY CONFIGURATIONS MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 28: SEGMENT GROWTH POTENTIAL, BY END-USER INDUSTRY, IN 2024

FIGURE 29: CONSUMER ELECTRONICS MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 30: HEALTHCARE & MEDICAL MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 31: SMART PACKAGING MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 32: AUTOMOTIVE & TRANSPORTATION MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 33: INDUSTRIAL & MANUFACTURING MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 34: LOGISTICS & SUPPLY CHAIN MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 35: MILITARY & DEFENSE MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 36: RETAIL MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 37: OTHER END-USER INDUSTRIES MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 38: SEGMENT GROWTH POTENTIAL, BY SALES CHANNEL, IN 2024

FIGURE 39: DIRECT SALES (OEM SUPPLY) MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 40: DISTRIBUTORS & WHOLESALERS MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 41: ONLINE CHANNELS MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 42: SPECIALTY RETAILERS MARKET SIZE, 2025-2032 (IN $ MILLION)