JAPAN FLEXIBLE THIN FILM AND PRINTED BATTERY MARKET FORECAST 2025-2032

Japan Flexible Thin Film and Printed Battery Market by Chargeability (Rechargeable, Non-Rechargeable), Market by Capacity (Below 10 MAH, 10-100 MAH, Above 100 MAH), Market by Material (Lithium-Ion, Zinc-Based, Nickel-Metal Hydride, Solid-State Electrolytes, Polymer Electrolytes, Aqueous Electrolytes), Market by Form Factor/Shape (Curved, Rollable, Stretchable, Conformal, Micro-Battery Configurations), Market by End-User Industry (Consumer Electronics, Healthcare & Medical, Smart Packaging, Automotive & Transportation, Industrial & Manufacturing, Logistics & Supply Chain, Military & Defense, Retail, Other End-User Industries), Market by Sales Channel (Direct Sales (OEM Supply), Distributors & Wholesalers, Online Channels, Specialty Retailers), by Geography

日本フレキシブル薄膜・プリンテッドバッテリー市場:充電性(充電式、非充電式)、容量(10MAH未満、10~100MAH、100MAH超)、材質(リチウムイオン、亜鉛系、ニッケル水素、固体電解質、ポリマー電解質、水性電解質)、フォームファクター/形状(湾曲型、巻き取り型、伸縮型、コンフォーマル型、マイクロバッテリー構成)、エンドユーザー産業(民生用電子機器、ヘルスケア・医療、スマートパッケージング、自動車・輸送、工業・製造、物流・サプライチェーン、軍事・防衛、小売、その他エンドユーザー産業)、販売チャネル(直接販売(OEM供給)、販売代理店・卸売業者、オンラインチャネル、専門小売業者)、地域別

| 出版 | Inkwood Research |

| 出版年月 | 2026年01月 |

| ページ数 | 156 |

| 価格 | 記載以外のライセンスについてはお問合せください。 |

| シングルユーザ | USD 1,100 |

| 企業ライセンス | USD 1,500 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-11227 |

| タイトル | Single User Price (USD) | |

| 世界のフレキシブル薄膜電池と印刷電池市場予測 2025-2032年 | GLOBAL FLEXIBLE THIN FILM AND PRINTED BATTERY MARKET FORECAST 2025-2032 | USD 2,900 |

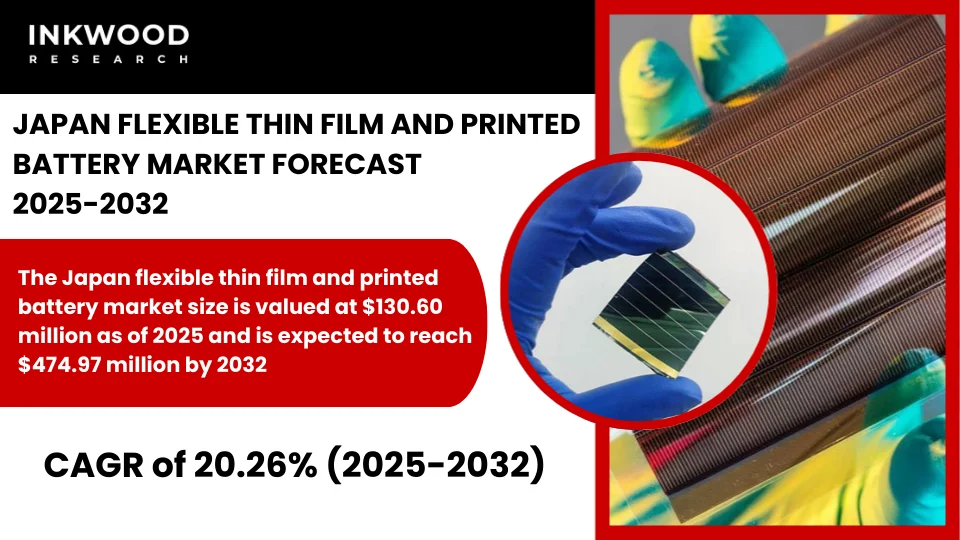

日本のフレキシブル薄膜および印刷電池市場規模は、2025年時点で1億3,060万ドルと評価されており、2025年から2032年の予測期間中に20.26%のCAGRで成長し、2032年には4億7,497万ドルに達すると予想されています。

セグメンテーション分析

日本のフレキシブル薄膜電池およびプリンテッド電池市場は、充電性、容量、材料、フォームファクター/形状、エンドユーザー産業、および販売チャネルに分類されています。材料セグメントはさらに、リチウムイオン、亜鉛系、ニッケル水素、固体電解質、ポリマー電解質、および水性電解質に分類されます。

材料分野において、固体電解質は2032年まで日本にとって最もダイナミックかつ戦略的に重要な分野の一つとなる見込みです。セラミックおよびポリマー電解質において数十年にわたり蓄積されたノウハウと、官民双方からの多額の投資により、日本企業は安全で高性能かつ柔軟な固体設計の最前線に立っています。

これらの電解質は可燃性液体成分を排除し、皮膚接触型および埋め込み型医療機器の安全性を飛躍的に向上させるとともに、真に曲げやすく伸縮性のある形状を実現します。大手自動車メーカーや産業界の大手企業は、リークゼロと長期安定性が不可欠な次世代センサーネットワーク向けに、ソリッドステートフレキシブルセルの採用をますます増やしています。

ポリマー電解質は、この進歩を密接に補完し、優れた柔軟性とロールツーロールプロセスにおける容易な印刷性を提供します。現在進行中の産学連携プロジェクトでは、イオン伝導性と機械的耐久性の向上が進められており、ウェアラブル健康モニターやソフトロボティクスに最適な材料となっています。

亜鉛系および水系システムは使い捨て用途で着実に使用されていますが、日本の産業・医療分野における高価格帯への許容度は、固体電解質や先進ポリマー系がもたらす優れた安全性とサイクル寿命を強く支持しています。その結果、日本が研究室レベルでの卓越性から、選択的で高利益率の商用展開へと移行する中で、これら2つの電解質ファミリーに関する専門知識を深める企業は、最も高い価値シェアを獲得する可能性が高いでしょう。

KEY FINDINGS

The Japan flexible thin film and printed battery market size is valued at $130.60 million as of 2025 and is expected to reach $474.97 million by 2032, progressing with a CAGR of 20.26% during the forecast period, 2025-2032.

JAPAN-FLEXIBLE-THIN-FILM-AND-PRINTED-BATTERY-MARKET-FORECAST-2025-2032

MARKET INSIGHTS

The market’s growth in Japan is firmly rooted in the country’s world-leading materials science expertise and precision manufacturing heritage. Deep academic-corporate collaboration channels cutting-edge research directly into practical prototypes, particularly for high-reliability applications. Government funding through initiatives like the Moonshot Research and Development Program and Green Innovation Fund actively supports sustainable, next-generation energy storage projects.

Additionally, rising demand for ultra-miniature power sources in Industry 4.0 sensors, automotive diagnostics, and medical patches creates steady niche opportunities. While high safety expectations and rigorous validation requirements extend development timelines, they also ensure that solutions entering the market meet the strictest global standards, giving Japanese developers a strong reputation advantage in premium segments.

At the same time, conservative end-user preferences and relatively high domestic production costs slow the shift from pilot to volume production. Fragmented demand across specialized applications makes large-scale economies challenging to achieve quickly. Nevertheless, co-location of R&D labs with major OEMs shortens validation cycles, and an increasing focus on recyclable, eco-friendly chemistries aligns perfectly with Japan’s carbon-neutral 2050 goals. These factors combine to create a market that advances deliberately yet delivers exceptionally reliable and innovative flexible battery solutions.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2025-2032 |

| Base Year | 2024 |

| Market Historical Years | 2018-2023 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Chargeability, Capacity, Form Factor/Shape, End-User Industry, Sales Channel, and Material |

| Country Analyzed | Japan |

| Companies Analyzed | Panasonic Corporation, Samsung SDI, LG Chem Ltd, NGK Insulators Ltd, Murata Manufacturing Co Ltd, NEC Corporation |

SEGMENTATION ANALYSIS

The Japan flexible thin film and printed battery market is segmented into chargeability, capacity, material, form factor/shape, end-user industry, and sales channel. The material segment is further categorized into lithium-ion, zinc-based, nickel-metal hydride, solid-state electrolytes, polymer electrolytes, and aqueous electrolytes.

Within the material landscape, solid-state electrolytes are set to represent one of the most dynamic and strategically important category for Japan through 2032. Decades of accumulated know-how in ceramic and polymer electrolytes, combined with heavy investment from both government and private sectors, position Japanese firms at the forefront of safe, high-performance flexible solid-state designs.

These electrolytes eliminate flammable liquid components, dramatically improving safety for skin-contact and implantable medical devices while enabling truly bendable and stretchable formats. Leading automakers and industrial giants increasingly specify solid-state flexible cells for next-generation sensor networks, where zero leakage and long-term stability are non-negotiable requirements.

Polymer electrolytes closely complement this progress, offering excellent flexibility and easier printability for roll-to-roll processes. Ongoing university-industry projects continue to enhance ionic conductivity and mechanical durability, making them ideal for wearable health monitors and soft robotics.

Although zinc-based and aqueous systems see steady use in disposable applications, the premium pricing tolerance of Japan’s industrial and medical sectors strongly favors the superior safety and cycle life delivered by solid-state and advanced polymer variants. As a result, companies that deepen expertise in these two electrolyte families stand to capture the highest value share as Japan transitions from laboratory excellence to selective, high-margin commercial deployments.

COMPETITIVE INSIGHTS

Some of the top players operating in the Japan flexible thin film and printed battery market include Panasonic Corporation, Samsung SDI, LG Chem Ltd, NGK Insulators Ltd, Murata Manufacturing Co Ltd, and NEC Corporation.

Murata Manufacturing Co Ltd stands out as a home-grown powerhouse deeply embedded in Japan’s flexible and printed battery evolution. Headquartered in Kyoto, the company is a global leader in electronic components with particular strength in ceramic-based energy devices and miniaturization technology. Its relevant offerings include ultra-thin all-ceramic solid-state batteries and flexible lithium-ion cells designed for medical patches, industrial sensors, and hearables.

Murata’s distinctive vertically integrated model, from advanced materials development to high-precision assembly, combined with decades of experience meeting Japan’s stringent PSE safety mark and ISO 13485 medical standards, gives it unmatched credibility in reliability-critical applications. Close, long-term co-development relationships with domestic automotive, healthcare, and robotics leaders further solidify its strategic position in the premium segment of the Japanese market.

COMPANY PROFILES

- PANASONIC CORPORATION

- SAMSUNG SDI

- LG CHEM LTD

- NGK INSULATORS LTD

- MURATA MANUFACTURING CO LTD

- NEC CORPORATION

TABLE OF CONTENTS

- RESEARCH SCOPE & METHODOLOGY

1.1. STUDY OBJECTIVES

1.2. METHODOLOGY

1.3. ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

2.1. MARKET SIZE & FORECAST

2.2. MARKET OVERVIEW

2.3. SCOPE OF STUDY

2.4. CRISIS SCENARIO ANALYSIS

2.5. MAJOR MARKET FINDINGS

2.5.1. JAPAN HAS STRONG ACADEMIC EXPERTISE AND MATERIALS SCIENCE LEADERSHIP, TRANSLATING INTO ADVANCED FLEXIBLE BATTERY PROTOTYPES

2.5.2. AUTOMOTIVE AND INDUSTRIAL ELECTRONICS COMPANIES ARE INVESTIGATING PRINTED BATTERIES FOR LOW-POWER SENSING AND IDENTIFICATION USES

2.5.3. CONSERVATIVE REGULATORY ENVIRONMENT AND RIGOROUS SAFETY REQUIREMENTS DRIVE HIGH QUALITY CONTROL STANDARDS IN DEVELOPMENT

2.5.4. SMALL SCALE PILOTS ARE COMMON, BUT WIDE COMMERCIAL ADOPTION IS SLOWER DUE TO HIGH RELIABILITY EXPECTATIONS

- MARKET DYNAMICS

3.1. KEY DRIVERS

3.1.1. DEEP MATERIALS SCIENCE CAPABILITIES AND PRECISION MANUFACTURING EXPERTISE ARE ENABLING HIGH PERFORMANCE DEVICE PROOFS OF CONCEPT

3.1.2. STRONG LINKAGES BETWEEN UNIVERSITIES AND CORPORATIONS ARE FUNNELING TALENT INTO APPLIED R AND D FOR PRINTED ENERGY

3.1.3. GOVERNMENT FUNDING FOR NEXT GENERATION ELECTRONICS AND SUSTAINABLE MATERIALS IS SUPPORTING INNOVATION PROJECTS

3.1.4. DEMAND FOR MINIATURIZED SENSORS IN INDUSTRY 4.0 USE CASES IS CREATING NICHE APPLICATION OPPORTUNITIES

3.2. KEY RESTRAINTS

3.2.1. HIGH QUALITY AND SAFETY EXPECTATIONS IN THE JAPANESE INDUSTRY LENGTHEN TIME TO MARKET FOR NOVEL BATTERY FORM FACTORS

3.2.2. FRAGMENTED APPLICATION DEMAND MAKES IT HARD TO ACHIEVE LARGE VOLUME MANUFACTURING ECONOMIES OF SCALE

3.2.3. RELATIVELY HIGH LABOUR AND PRODUCTION COSTS REDUCE PRICE COMPETITIVENESS AGAINST IMPORTED SOLUTIONS

3.2.4. CONSERVATIVE END USERS REQUIRE EXTENSIVE FIELD VALIDATION BEFORE ACCEPTANCE IN CRITICAL APPLICATIONS

- KEY ANALYTICS

4.1. KEY MARKET TRENDS

4.1.1. EMPHASIS ON SUSTAINABLE AND RECYCLABLE MATERIALS IS INCREASING AMONG JAPANESE DEVELOPERS

4.1.2. COLOCATION OF R&D FACILITIES WITH OEMS IS SPEEDING UP VALIDATION CYCLES

4.1.3. FOCUS ON MINIATURE SENSORS AND RFID INTEGRATION IS PUSHING DEMAND FOR THIN AREA POWER SOURCES

4.1.4. STRATEGIC PILOTS WITH INDUSTRIAL CUSTOMERS ARE PRIORITIZED OVER MASS MARKET LAUNCHES

4.2. PORTER’S FIVE FORCES ANALYSIS

4.2.1. BUYERS POWER

4.2.2. SUPPLIERS POWER

4.2.3. SUBSTITUTION

4.2.4. NEW ENTRANTS

4.2.5. INDUSTRY RIVALRY

4.3. GROWTH PROSPECT MAPPING

4.3.1. GROWTH PROSPECT MAPPING FOR JAPAN

4.4. MARKET MATURITY ANALYSIS

4.5. MARKET CONCENTRATION ANALYSIS

4.6. VALUE CHAIN ANALYSIS

4.6.1. MATERIALS SUPPLIERS

4.6.2. CONDUCTIVE INK MAKERS

4.6.3. SUBSTRATE PRODUCERS

4.6.4. CELL DESIGN ENGINEERS

4.6.5. ROLL TO ROLL FABRICATORS

4.6.6. MODULE INTEGRATORS

4.6.7. OEM ASSEMBLERS

4.6.8. AFTERMARKET SERVICE

4.7. KEY BUYING CRITERIA

4.7.1. ENERGY DENSITY PER AREA

4.7.2. FLEXIBILITY RATING

4.7.3. CYCLE LIFE PERFORMANCE

4.7.4. CERTIFIED SAFETY

4.8. REGULATORY FRAMEWORK

- FLEXIBLE THIN FILM AND PRINTED BATTERY MARKET BY CHARGEABILITY

5.1. RECHARGEABLE

5.1.1. MARKET FORECAST FIGURE

5.1.2. SEGMENT ANALYSIS

5.2. NON-RECHARGEABLE

5.2.1. MARKET FORECAST FIGURE

5.2.2. SEGMENT ANALYSIS

- FLEXIBLE THIN FILM AND PRINTED BATTERY MARKET BY CAPACITY

6.1. BELOW 10 MAH

6.1.1. MARKET FORECAST FIGURE

6.1.2. SEGMENT ANALYSIS

6.2. 10-100 MAH

6.2.1. MARKET FORECAST FIGURE

6.2.2. SEGMENT ANALYSIS

6.3. ABOVE 100 MAH

6.3.1. MARKET FORECAST FIGURE

6.3.2. SEGMENT ANALYSIS

- FLEXIBLE THIN FILM AND PRINTED BATTERY MARKET BY MATERIAL

7.1. LITHIUM-ION

7.1.1. MARKET FORECAST FIGURE

7.1.2. SEGMENT ANALYSIS

7.2. ZINC-BASED

7.2.1. MARKET FORECAST FIGURE

7.2.2. SEGMENT ANALYSIS

7.3. NICKEL-METAL HYDRIDE

7.3.1. MARKET FORECAST FIGURE

7.3.2. SEGMENT ANALYSIS

7.4. SOLID-STATE ELECTROLYTES

7.4.1. MARKET FORECAST FIGURE

7.4.2. SEGMENT ANALYSIS

7.5. POLYMER ELECTROLYTES

7.5.1. MARKET FORECAST FIGURE

7.5.2. SEGMENT ANALYSIS

7.6. AQUEOUS ELECTROLYTES

7.6.1. MARKET FORECAST FIGURE

7.6.2. SEGMENT ANALYSIS

- FLEXIBLE THIN FILM AND PRINTED BATTERY MARKET BY FORM FACTOR/SHAPE

8.1. CURVED

8.1.1. MARKET FORECAST FIGURE

8.1.2. SEGMENT ANALYSIS

8.2. ROLLABLE

8.2.1. MARKET FORECAST FIGURE

8.2.2. SEGMENT ANALYSIS

8.3. STRETCHABLE

8.3.1. MARKET FORECAST FIGURE

8.3.2. SEGMENT ANALYSIS

8.4. CONFORMAL

8.4.1. MARKET FORECAST FIGURE

8.4.2. SEGMENT ANALYSIS

8.5. MICRO-BATTERY CONFIGURATIONS

8.5.1. MARKET FORECAST FIGURE

8.5.2. SEGMENT ANALYSIS

- FLEXIBLE THIN FILM AND PRINTED BATTERY MARKET BY END-USER INDUSTRY

9.1. CONSUMER ELECTRONICS

9.1.1. MARKET FORECAST FIGURE

9.1.2. SEGMENT ANALYSIS

9.2. HEALTHCARE & MEDICAL

9.2.1. MARKET FORECAST FIGURE

9.2.2. SEGMENT ANALYSIS

9.3. SMART PACKAGING

9.3.1. MARKET FORECAST FIGURE

9.3.2. SEGMENT ANALYSIS

9.4. AUTOMOTIVE & TRANSPORTATION

9.4.1. MARKET FORECAST FIGURE

9.4.2. SEGMENT ANALYSIS

9.5. INDUSTRIAL & MANUFACTURING

9.5.1. MARKET FORECAST FIGURE

9.5.2. SEGMENT ANALYSIS

9.6. LOGISTICS & SUPPLY CHAIN

9.6.1. MARKET FORECAST FIGURE

9.6.2. SEGMENT ANALYSIS

9.7. MILITARY & DEFENSE

9.7.1. MARKET FORECAST FIGURE

9.7.2. SEGMENT ANALYSIS

9.8. RETAIL

9.8.1. MARKET FORECAST FIGURE

9.8.2. SEGMENT ANALYSIS

9.9. OTHER END-USER INDUSTRIES (RESEARCH & ACADEMIA, AEROSPACE)

9.9.1. MARKET FORECAST FIGURE

9.9.2. SEGMENT ANALYSIS

- FLEXIBLE THIN FILM AND PRINTED BATTERY MARKET BY SALES CHANNEL

10.1. DIRECT SALES (OEM SUPPLY)

10.1.1. MARKET FORECAST FIGURE

10.1.2. SEGMENT ANALYSIS

10.2. DISTRIBUTORS & WHOLESALERS

10.2.1. MARKET FORECAST FIGURE

10.2.2. SEGMENT ANALYSIS

10.3. ONLINE CHANNELS

10.3.1. MARKET FORECAST FIGURE

10.3.2. SEGMENT ANALYSIS

10.4. SPECIALTY RETAILERS

10.4.1. MARKET FORECAST FIGURE

10.4.2. SEGMENT ANALYSIS

- COMPETITIVE LANDSCAPE

11.1. KEY STRATEGIC DEVELOPMENTS

11.1.1. MERGERS & ACQUISITIONS

11.1.2. PRODUCT LAUNCHES & DEVELOPMENTS

11.1.3. PARTNERSHIPS & AGREEMENTS

11.1.4. BUSINESS EXPANSIONS & DIVESTITURES

11.2. COMPANY PROFILES

11.2.1. PANASONIC CORPORATION

11.2.1.1. COMPANY OVERVIEW

11.2.1.2. PRODUCTS

11.2.1.3. STRENGTHS & CHALLENGES

11.2.2. SAMSUNG SDI

11.2.2.1. COMPANY OVERVIEW

11.2.2.2. PRODUCTS

11.2.2.3. STRENGTHS & CHALLENGES

11.2.3. LG CHEM LTD

11.2.3.1. COMPANY OVERVIEW

11.2.3.2. PRODUCTS

11.2.3.3. STRENGTHS & CHALLENGES

11.2.4. NGK INSULATORS LTD

11.2.4.1. COMPANY OVERVIEW

11.2.4.2. PRODUCTS

11.2.4.3. STRENGTHS & CHALLENGES

11.2.5. MURATA MANUFACTURING CO LTD

11.2.5.1. COMPANY OVERVIEW

11.2.5.2. PRODUCTS

11.2.5.3. STRENGTHS & CHALLENGES

11.2.6. NEC CORPORATION

11.2.6.1. COMPANY OVERVIEW

11.2.6.2. PRODUCTS

11.2.6.3. STRENGTHS & CHALLENGES

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – FLEXIBLE THIN FILM AND PRINTED BATTERY

TABLE 2: MARKET BY CHARGEABILITY, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 3: MARKET BY CHARGEABILITY, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 4: MARKET BY CAPACITY, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 5: MARKET BY CAPACITY, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 6: MARKET BY MATERIAL, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 7: MARKET BY MATERIAL, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 8: MARKET BY FORM FACTOR/SHAPE, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 9: MARKET BY FORM FACTOR/SHAPE, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 10: MARKET BY END-USER INDUSTRY, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 11: MARKET BY END-USER INDUSTRY, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 12: MARKET BY SALES CHANNEL, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 13: MARKET BY SALES CHANNEL, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 14: KEY PLAYERS OPERATING IN THE JAPANESE MARKET

TABLE 15: LIST OF MERGERS & ACQUISITIONS

TABLE 16: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 17: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 18: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR JAPAN

FIGURE 4: MARKET MATURITY ANALYSIS

FIGURE 5: MARKET CONCENTRATION ANALYSIS

FIGURE 6: VALUE CHAIN ANALYSIS

FIGURE 7: KEY BUYING CRITERIA

FIGURE 8: SEGMENT GROWTH POTENTIAL, BY CHARGEABILITY, IN 2024

FIGURE 9: RECHARGEABLE MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 10: NON-RECHARGEABLE MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 11: SEGMENT GROWTH POTENTIAL, BY CAPACITY, IN 2024

FIGURE 12: BELOW 10 MAH MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 13: 10-100 MAH MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 14: ABOVE 100 MAH MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 15: SEGMENT GROWTH POTENTIAL, BY MATERIAL, IN 2024

FIGURE 16: LITHIUM-ION MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 17: ZINC-BASED MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 18: NICKEL-METAL HYDRIDE MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 19: SOLID-STATE ELECTROLYTES MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 20: POLYMER ELECTROLYTES MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 21: AQUEOUS ELECTROLYTES MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 22: SEGMENT GROWTH POTENTIAL, BY FORM FACTOR/SHAPE, IN 2024

FIGURE 23: CURVED MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 24: ROLLABLE MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 25: STRETCHABLE MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 26: CONFORMAL MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 27: MICRO-BATTERY CONFIGURATIONS MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 28: SEGMENT GROWTH POTENTIAL, BY END-USER INDUSTRY, IN 2024

FIGURE 29: CONSUMER ELECTRONICS MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 30: HEALTHCARE & MEDICAL MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 31: SMART PACKAGING MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 32: AUTOMOTIVE & TRANSPORTATION MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 33: INDUSTRIAL & MANUFACTURING MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 34: LOGISTICS & SUPPLY CHAIN MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 35: MILITARY & DEFENSE MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 36: RETAIL MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 37: OTHER END-USER INDUSTRIES MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 38: SEGMENT GROWTH POTENTIAL, BY SALES CHANNEL, IN 2024

FIGURE 39: DIRECT SALES (OEM SUPPLY) MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 40: DISTRIBUTORS & WHOLESALERS MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 41: ONLINE CHANNELS MARKET SIZE, 2025-2032 (IN $ MILLION)

FIGURE 42: SPECIALTY RETAILERS MARKET SIZE, 2025-2032 (IN $ MILLION)