Ultra-high Purity Graphite Market - Global Forecast to 2030

Ultra-high-purity Graphite Market by Source (Natural, Synthetic), Type (Pyrolytic Graphite, Synthetic Isotropic Graphite, Purified Natural Vein Graphite, High-Purity Synthetic Graphite Powder), Application, End-Use Industry, and Region - Global Forecast to 2030

超高純度グラファイト市場 - 供給源(天然、合成)、種類(熱分解黒鉛、合成等方性黒鉛、精製天然鉱脈黒鉛、高純度合成黒鉛粉末)、用途、最終用途産業、地域別 - 2030年までの世界予測

| 出版 | MarketsandMarkets |

| 出版年月 | 2025年12月 |

| ページ数 | 286 |

| 図表数 | 314 |

| 価格 | 記載以外のライセンスについてはお問合せください。 |

| シングルユーザ | USD 4,950 |

| 企業ライセンス | USD 10,000 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-11206 |

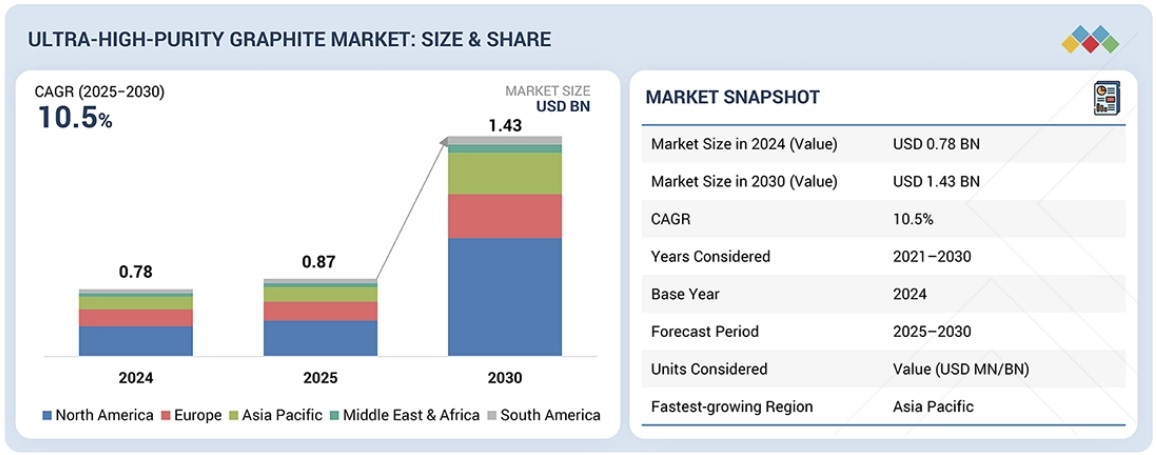

超高純度グラファイト市場は、2025年の8億7,000万米ドルから2030年には14億3,000万米ドルに成長し、予測期間中に年平均成長率(CAGR)10.5%で成長すると予測されています。あらゆるエネルギー源からの再生可能エネルギー生産コストの低下、電気分解技術の進歩、電力業界および燃料電池電気自動車からの需要増加など、いくつかの主要な要因が超高純度グラファイト市場を牽引しています。超高純度グラファイトは、化学、モビリティ、グリッドインジェクション、電力など、さまざまな業界で使用されています。排出ガスゼロの製造プロセスにより、従来のグレー水素、ブラウン水素、ブルー水素の代替品としてますます注目を集めています。技術の進歩により、超高純度グラファイトのコスト競争力も向上しています。この持続可能な燃料源は、さまざまな最終用途産業において、化石燃料の現実的な代替品として浮上しています。

調査範囲:

本レポートでは、超高純度グラファイト市場を、種類、用途、供給源、最終用途産業、地域に基づいてセグメント化し、市場規模を予測しています。主要プレーヤーを戦略的にプロファイルし、市場シェアとコアコンピタンスを包括的に分析しています。また、これらのプレーヤーによる市場における事業拡大、契約、買収などの競争動向も追跡・分析しています。

レポートを購入する理由:

本レポートは、超高純度グラファイト市場とそのセグメントにおける収益数値の近似値を提供することで、市場リーダー企業や新規参入企業を支援することが期待されています。また、本レポートは、市場関係者が市場の競争環境をより深く理解し、ビジネスポジションを強化するための貴重な洞察を獲得し、効果的な市場開拓戦略を策定する上でも役立つことが期待されます。さらに、市場動向を把握し、主要な市場牽引要因、制約要因、課題、そして機会に関する情報を提供します。

本レポートは、以下の点について洞察を提供します。

超高純度グラファイト市場の成長に影響を与える重要な推進要因(EVおよびエネルギー貯蔵におけるリチウムイオン電池の採用拡大、半導体およびシリコン加工産業からの需要増加、太陽光発電製造の拡大)、制約要因(サプライチェーンの集中化と高い輸入依存度、環境および規制遵守の課題)、機会(先進的な高温原子炉プログラムの開発、航空宇宙および極超音速プラットフォームにおける炭素炭素熱防御システムの利用増加)、および課題(精製および処理の強度に起因する高生産コスト)の分析。

- 製品開発/イノベーション:超高純度グラファイト市場における今後の技術、研究開発活動に関する詳細な洞察。

- 市場開発:有望な市場に関する包括的な情報。本レポートでは、超高純度グラファイト市場を地域ごとに分析しています。

- 市場の多様化:超高純度グラファイト市場における新製品、様々なタイプ、未開拓地域、最近の動向、投資に関する包括的な情報。

- 競合評価:超高純度グラファイト市場の主要プレーヤーであるSuperior Graphite(米国)、Focus Graphite(カナダ)、東洋炭素株式会社(日本)、Mersen(フランス)、HPMS Graphite(米国)、Ceylon Graphite Corp.(カナダ)、Sarytogan Graphite Limited(オーストラリア)、Amsted Graphite Materials(米国)、GrafTech International(米国)、Entegris(米国)、East Carbon(中国)、Atlas Critical Minerals(ブラジル)、XRD Graphite Manufacturing Co., Ltd.(中国)、SEC Carbon Limited(日本)、SGL Carbon(ドイツ)、American Elements(米国)、およびCanada Carbon(カナダ)などの主要プレーヤーの市場シェア、成長戦略、および製品提供の詳細な評価。

Report Description

The ultra-high-purity graphite market is projected to grow from USD 0.87 billion in 2025 to USD 1.43 billion by 2030, at a CAGR of 10.5% during the forecast period. Several key factors, such as the decreasing cost of renewable energy production from all sources, advancements in electrolysis technologies, and a rising demand from the power industry and fuel cell electric vehicles, are driving the market for ultra-high-purity graphite. Ultra-high-purity graphite has applications across various industries, including chemicals, mobility, grid injection, and power. It is increasingly being seen as a replacement for conventional gray, brown, and blue hydrogen due to its zero-emission production process. Technological advancements have also made ultra-high-purity graphite more cost-competitive. This sustainable fuel source is emerging as a viable alternative to fossil fuels across various end-use industries.

Ultra-high Purity Graphite Market – Global Forecast to 2030

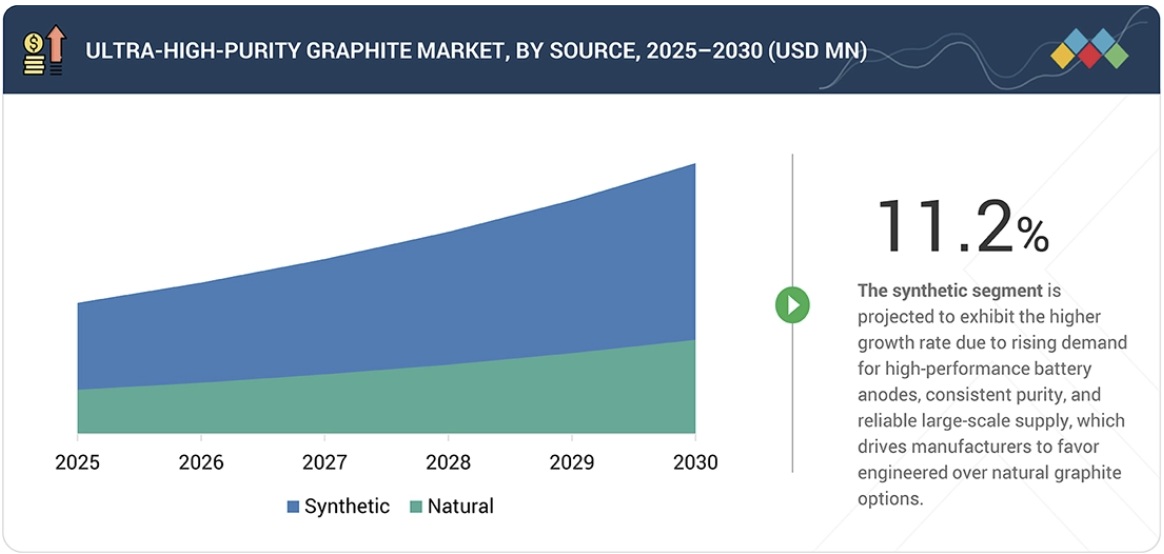

“By source, the synthetic graphite segment of the ultra-high-purity market is estimated to register the fastest growth, in terms of value, during the forecast period.”

Synthetic graphite exhibits the fastest, as well as the highest growth rate, among the source segments in the ultra-high-purity (UHP) graphite market, driven by its unmatched purity, structural uniformity, and scalability, which surpass those of natural graphite. The demand is accelerating as high-tech industries, such as those for lithium-ion batteries, semiconductors, aerospace, and advanced nuclear reactors, require more materials with extremely low levels of impurities and precisely engineered performance characteristics. The rapid rise in the production of electric vehicles (EVs) along with large energy storage systems has been a major factor in favor of synthetic graphite, as it provides the anodes of high-performance batteries with the characteristics of excellent electrochemical stability, long cycle life, and rapid charging capabilities.

The global movement aimed at reinforcing domestic supply chains, reducing reliance on mining natural graphite in specific regions, and eliminating contamination risks are some of the factors that are prompting manufacturers to turn towards engineered synthetic alternatives. Upgraded purification technologies, more efficient graphitization processes, and investment in renewable-powered production are all contributing to the market appeal of artificial graphite, positioning it as an essential material that supports the rapid growth of modern energy and semiconductor ecosystems.

Ultra-high Purity Graphite Market – Global Forecast to 2030 – by source

“By application, the lithium-ion battery anodes segment is estimated to be the fastest-growing segment of the ultra-high-purity graphite market during the forecast period.”

Based on application, the lithium-ion battery anodes are the fastest-growing source segment in the ultra-high-purity graphite market, driven by the rapid adoption of electric vehicles, grid-scale energy storage, and portable electronics. Ultra-high-purity graphite is increasingly used in such applications due to its superior electrical conductivity, thermal stability, and structural integrity, resulting in enhanced battery efficiency and a longer life cycle. The primary battery makers are investing in advanced synthetic and coated graphite to enhance energy density and charging performance. The incentives provided by the government to support the production of electric vehicles and the integration of renewable energy sources are also increasing the demand for graphite. Additionally, the continued investment in R&D of next-generation battery chemicals is broadening the use of graphite in both conventional and solid-state batteries. All these factors combined make the lithium-ion battery anode segment a key driver of global market growth for ultra-high-purity graphite.

Ultra-high Purity Graphite Market – Global Forecast to 2030 – region

“The ultra-high-purity graphite market in Asia is projected to register the fastest growth, in terms of value and volume, during the forecast period.”

Asia Pacific is expected to be the largest market for ultra-high-purity graphite throughout the forecast period, primarily due to the rapid growth of the semiconductor, electronics, and electric vehicle manufacturing sectors in the region. The countries, including China, Japan, South Korea, and Taiwan, are considered to be the most important places worldwide for the production of chips, batteries, and the processing of advanced materials, which are the main users of ultra-high-purity graphite for wafer handling, high-temperature furnace components, lithium-ion battery anodes, and precision thermal management systems.

High investments in semiconductor capacity expansion by governments, aggressive EV adoption targets, and the localization of battery supply chains are further accelerating demand in the region. Moreover, the Asia Pacific is home to some of the largest producers and purification facilities of ultra-high-purity graphite globally. Hence, the region has an advantage in terms of manufacturing scale, cost efficiency, and technological capability. The increasing adoption of renewable energy systems, advanced nuclear technologies, and high-performance industrial processes is also a factor driving the market’s growth in the region. Therefore, all these reasons together make the Asia Pacific a leading region in the ultra-high-purity graphite market, both in terms of size and growth rate in the years to come.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 – 45%, Tier 2 – 22%, and Tier 3 – 33%

- By Designation: C-Level Executives– 50%, Directors– 10%, and Others – 40%

- By Region: North America – 17%, Asia Pacific – 17%, Europe – 33%, Middle East & Africa – 25%, and South America – 8%

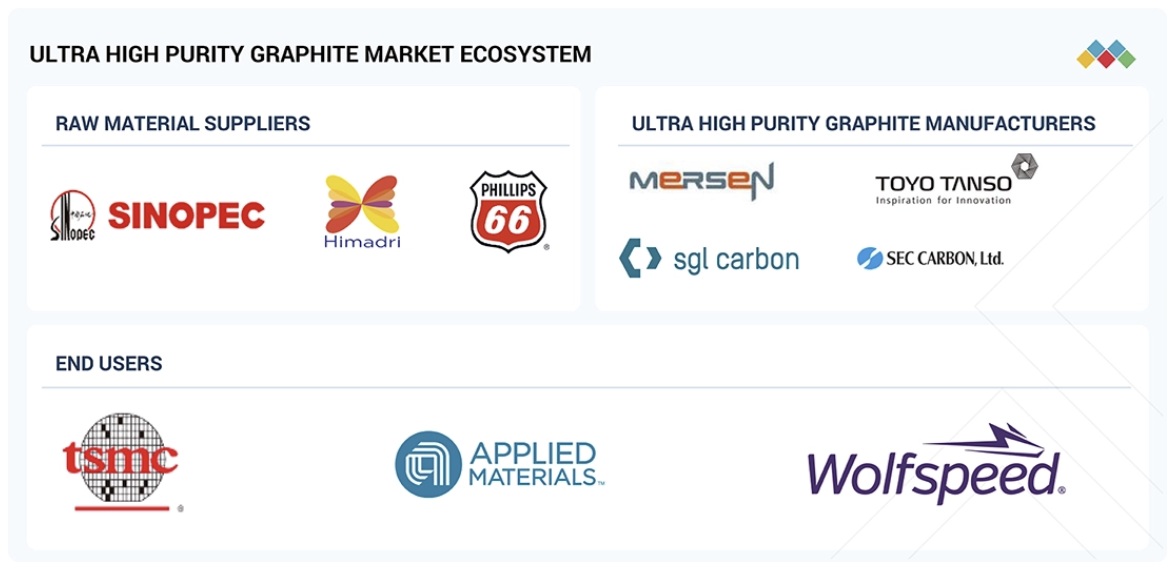

Ultra-high Purity Graphite Market – Global Forecast to 2030 – ecosystemjpg

Leading players operating in the ultra-high-purity graphite market include Mersen (France), Superior Graphite (US), Toyo Tanso Co., Ltd. (Japan), SGL Carbon (Germany), and GrafTech International (US). These key players are significant contributors to the ultra-high-purity graphite market. These players have adopted various strategies, including agreements, joint ventures, and expansions, to increase their market share and business revenue.

Research Coverage:

The report defines segments and projects the size of the ultra-high-purity graphite market based on type, application, source, end-use industry, and region. It strategically profiles the key players and comprehensively analyzes their market shares and core competencies. It also tracks and analyzes competitive developments, such as expansions, agreements, and acquisitions undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help market leaders/new entrants by providing them with the closest approximations of revenue numbers for the ultra-high-purity graphite market and its segments. This report is also expected to help stakeholders gain a deeper understanding of the market’s competitive landscape, acquire valuable insights to enhance their business positions, and develop effective go-to-market strategies. It also enables stakeholders to understand the market’s pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of critical drivers (Growing adoption of lithium-ion batteries in EV and energy storage, rising demand from semiconductor and silicon processing industries, expansion of solar PV manufacturing), restraints (Supply chain concentration and high import dependency, environmental and regulatory compliance challenges), opportunities (Development of advanced high-temperature nuclear reactor programs, increasing use of carbon-carbon thermal protection systems in aerospace and hypersonic platforms), and challenges (High production costs driven by the intensity of purification and processing) that are influencing the growth of the ultra-high-purity graphite market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities in the ultra-high-purity graphite market.

- Market Development: Comprehensive information about lucrative markets – the report analyzes the ultra-high-purity graphite market across regions.

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the ultra-high-purity graphite market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, such as Superior Graphite (US), Focus Graphite (Canada), Toyo Tanso Co., Ltd. (Japan), Mersen (France), HPMS Graphite (US), Ceylon Graphite Corp. (Canada), Sarytogan Graphite Limited (Australia), Amsted Graphite Materials (US), GrafTech International (US), Entegris (US), East Carbon (China), Atlas Critical Minerals (Brazil), XRD Graphite Manufacturing Co., Ltd. (China), SEC Carbon Limited (Japan), SGL Carbon (Germany), American Elements (US), and Canada Carbon (Canada), are the key players in ultra-high-purity graphite market.

Table of Contents

1 INTRODUCTION 27

1.1 STUDY OBJECTIVES 27

1.2 MARKET DEFINITION 27

1.3 STUDY SCOPE 28

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 28

1.3.2 INCLUSIONS & EXCLUSIONS 29

1.3.3 YEARS CONSIDERED 29

1.3.4 CURRENCY CONSIDERED 30

1.4 LIMITATIONS 30

1.5 STAKEHOLDERS 30

2 EXECUTIVE SUMMARY 31

2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS 31

2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS 32

2.3 DISRUPTIVE TRENDS IN THE MARKET 33

2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS 34

2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST 35

3 PREMIUM INSIGHTS 36

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ULTRA-HIGH PURITY GRAPHITE MARKET 36

3.2 ULTRA-HIGH PURITY GRAPHITE MARKET, BY SOURCE AND REGION 37

3.3 ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION 37

3.4 ULTRA-HIGH PURITY GRAPHITE MARKET, BY COUNTRY 38

4 MARKET OVERVIEW 39

4.1 INTRODUCTION 39

4.2 MARKET DYNAMICS 40

4.2.1 DRIVERS 40

4.2.1.1 Growing adoption of lithium-ion batteries in EV and energy storage 40

4.2.1.2 Rising demand from semiconductor and silicon processing industries 42

4.2.1.3 Expansion of solar PV manufacturing 43

4.2.2 RESTRAINTS 43

4.2.2.1 Supply chain concentration and high import dependency 43

4.2.2.2 Environmental and regulatory compliance challenges 44

4.2.3 OPPORTUNITIES 44

4.2.3.1 Development of advanced high-temperature nuclear reactor programs 44

4.2.3.2 Increasing use of carbon-carbon thermal protection systems in aerospace and hypersonic platforms 45

4.2.4 CHALLENGES 46

4.2.4.1 High production costs driven by purification and processing intensity 46

4.3 UNMET NEEDS AND WHITE SPACES 46

4.3.1 UNMET NEEDS IN ULTRA-HIGH PURITY GRAPHITE MARKET 46

4.3.2 WHITE SPACE OPPORTUNITIES 47

4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 47

4.4.1 INTERCONNECTED MARKETS 47

4.4.2 CROSS-SECTOR OPPORTUNITIES 48

4.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS 48

4.5.1 EMERGING BUSINESS MODELS 48

4.5.2 ECOSYSTEM SHIFTS 48

4.6 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 49

4.6.1 KEY MOVES AND STRATEGIC FOCUS 49

5 INDUSTRY TRENDS 50

5.1 PORTER’S FIVE FORCES ANALYSIS 50

5.1.1 THREAT OF NEW ENTRANTS 51

5.1.2 THREAT OF SUBSTITUTES 51

5.1.3 BARGAINING POWER OF SUPPLIERS 52

5.1.4 BARGAINING POWER OF BUYERS 52

5.1.5 INTENSITY OF COMPETITIVE RIVALRY 52

5.2 MACROECONOMICS INDICATORS 53

5.2.1 INTRODUCTION 53

5.2.2 GDP TRENDS AND FORECAST 53

5.2.3 TRENDS IN GLOBAL ELECTRONICS INDUSTRY 55

5.3 VALUE CHAIN ANALYSIS 56

5.4 ECOSYSTEM ANALYSIS 58

5.5 PRICING ANALYSIS 59

5.5.1 AVERAGE SELLING PRICE, BY KEY PLAYERS 59

5.5.2 AVERAGE SELLING PRICE TREND, BY REGION 60

5.6 TRADE ANALYSIS 62

5.6.1 IMPORT SCENARIO (HS CODE 380110) 62

5.6.2 EXPORT SCENARIO (HS CODE 380110) 64

5.7 KEY CONFERENCES AND EVENTS, 2025–2026 65

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 66

5.9 INVESTMENT AND FUNDING SCENARIO 67

5.10 CASE STUDY ANALYSIS 68

5.10.1 FABRICATING HIGH-PURITY GRAPHITE DISK ELECTRODES AS A COST-EFFECTIVE ALTERNATIVE IN FUNDAMENTAL ELECTROCHEMISTRY RESEARCH 68

5.10.2 PURIFICATION OF SPHERICAL GRAPHITE AS ANODE FOR LI-ION BATTERY:

A COMPARATIVE STUDY ON PURIFYING APPROACHES 68

5.10.3 ULTRA-HIGH TEMPERATURE PURIFICATION OF GRAPHITE FOR DEVELOPMENT OF A CONTINUOUS PROCESS 69

5.11 IMPACT OF 2025 US TARIFF ON ULTRA-HIGH PURITY GRAPHITE MARKET 70

5.11.1 INTRODUCTION 70

5.11.2 KEY TARIFF RATES 70

5.11.3 PRICE IMPACT ANALYSIS 71

5.11.4 IMPACT ON COUNTRIES/REGIONS 71

5.11.4.1 US 71

5.11.4.2 Europe 72

5.11.4.3 Asia Pacific 74

5.11.5 IMPACT ON END-USE INDUSTRIES 74

5.12 KEY EMERGING TECHNOLOGIES 75

5.12.1 HIGH-TEMPERATURE THERMAL PURIFICATION 75

5.12.2 CHEMICAL PURIFICATION OF GRAPHITE 75

5.12.3 CHEMICAL VAPOR DEPOSITION OF GRAPHITE 77

5.13 COMPLEMENTARY TECHNOLOGIES 77

5.13.1 PLASMA PURIFICATION OF GRAPHITE 77

5.14 ADJACENT TECHNOLOGIES 78

5.14.1 FLEXIBLE GRAPHITE PRODUCTION PROCESS 78

5.14.2 GRAPHITE INTERCALATION COMPOUND (GIC) SYNTHESIS 79

5.15 PATENT ANALYSIS 79

5.15.1 INTRODUCTION 79

5.15.2 METHODOLOGY 79

5.15.3 DOCUMENT TYPE 80

5.15.4 INSIGHTS 81

5.15.5 LEGAL STATUS OF PATENTS 81

5.15.6 JURISDICTION ANALYSIS 82

5.15.7 TOP APPLICANTS 83

5.15.8 LIST OF MAJOR PATENTS 83

5.16 FUTURE APPLICATIONS 86

5.16.1 SEMICONDUCTOR FURNACE COMPONENTS: NEXT-GENERATION CHIP MANUFACTURING 86

5.16.2 SOLAR-GRADE SILICON PRODUCTION: HIGH-EFFICIENCY PHOTOVOLTAICS 87

5.16.3 ADVANCED BATTERY TECHNOLOGIES: NEXT-GENERATION ENERGY STORAGE SYSTEMS 87

5.16.4 AEROSPACE & DEFENSE SYSTEMS: EXTREME-ENVIRONMENT STRUCTURAL COMPONENTS 87

5.16.5 NUCLEAR TECHNOLOGIES: NEXT-GENERATION REACTORS & FUSION SYSTEMS 88

5.17 IMPACT OF AI/GEN AI ON ULTRA-HIGH PURITY GRAPHITE MARKET 88

5.17.1 TOP USE CASES AND MARKET POTENTIAL 88

5.17.2 BEST PRACTICES: COMPANIES/INSTITUTIONS’ USE CASES 89

5.17.3 CASE STUDIES OF ULTRA-HIGH PURITY GRAPHITE 89

5.17.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS 90

5.17.5 CLIENTS’ READINESS TO ADOPT GENERATIVE AI IN ULTRA-HIGH PURITY GRAPHITE MARKET 90

5.18 SUCCESS STORIES AND REAL-WORLD APPLICATIONS 90

5.18.1 TOYO TANSO: ULTRA-HIGH PURITY ISOTROPIC GRAPHITE 90

5.18.2 MERSEN: ADVANCED PURIFIED GRAPHITE & SIC-COATED SOLUTIONS 91

5.18.3 TSMC (TAIWAN): SEMICONDUCTOR DEMAND DRIVING ULTRA-HIGH PURITY GRAPHITE ADOPTION 91

6 SUSTAINABILITY AND REGULATORY LANDSCAPE 92

6.1 REGIONAL REGULATIONS AND COMPLIANCE 92

6.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 92

6.1.2 INDUSTRY STANDARDS 94

6.2 SUSTAINABILITY INITIATIVES 94

6.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF ULTRA-HIGH PURITY GRAPHITE 94

6.2.1.1 Carbon impact reduction 94

6.2.1.2 Eco-applications 95

6.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES 95

6.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS 96

7 CUSTOMER LANDSCAPE & BUYER BEHAVIOR 97

7.1 DECISION-MAKING PROCESS 97

7.2 KEY STAKEHOLDERS AND BUYING CRITERIA 99

7.2.1 KEY STAKEHOLDERS IN BUYING PROCESS 99

7.2.2 BUYING CRITERIA 100

7.3 ADOPTION BARRIERS & INTERNAL CHALLENGES 101

7.4 UNMET NEEDS IN VARIOUS END-USE INDUSTRIES 103

7.5 MARKET PROFITIBILITY 104

7.5.1 REVENUE POTENTIAL 104

7.5.2 COST DYNAMICS 104

7.5.3 MARGIN OPPORTUNITIES IN KEY APPLICATIONS 104

8 TYPES OF ULTRA-HIGH PURITY GRAPHITE 105

8.1 INTRODUCTION 105

8.2 PYROLYTIC GRAPHITE 105

8.2.1 RISING USE OF PYROLYTIC GRAPHITE IN HIGH-TEMPERATURE AND ADVANCED INDUSTRIAL APPLICATIONS TO DRIVE DEMAND 105

8.3 SYNTHETIC ISOTROPIC GRAPHITE 106

8.3.1 INCREASING USE IN ENERGY STORAGE & ELECTRONICS TO DRIVE MARKET GROWTH 106

8.4 PURIFIED NATURAL VEIN GRAPHITE 107

8.4.1 INCREASING ADOPTION IN BATTERY AND ENERGY STORAGE APPLICATIONS TO FUEL DEMAND 107

8.5 HIGH-PURITY SYNTHETIC GRAPHITE POWDER 107

8.5.1 RISING APPLICATIONS IN ENERGY STORAGE, ELECTRONICS, AND HIGH-TEMPERATURE SYSTEMS DRIVING DEMAND 107

8.6 OTHERS 108

9 END-USE INDUSTRIES OF ULTRA-HIGH PURITY GRAPHITE 109

9.1 INTRODUCTION 109

9.2 NUCLEAR POWER 109

9.2.1 EXPANSION OF ADVANCED NUCLEAR TECHNOLOGIES ACCELERATING DEMAND FOR ULTRA-HIGH PURITY GRAPHITE 109

9.3 AEROSPACE & DEFENSE 110

9.3.1 NEED FOR SUPERIOR THERMAL AND STRUCTURAL PERFORMANCE DRIVING ADOPTION 110

9.4 ELECTRONICS 110

9.4.1 EXCEPTIONAL ELECTRICAL AND THERMAL CONDUCTIVITY FUELING DEMAND IN ADVANCED ELECTRONICS APPLICATIONS 110

9.5 ENERGY STORAGE 111

9.5.1 SUPERIOR STRENGTH AND ENERGY EFFICIENCY DRIVING GROWTH IN ENERGY STORAGE TECHNOLOGIES 111

9.6 METALLURGY 111

9.6.1 NEED FOR EXCEPTIONAL THERMAL STABILITY AND CHEMICAL PURITY TO SUPPORT MARKET GROWTH 111

9.7 SOLAR POWER 112

9.7.1 EXCEPTIONAL THERMAL STABILITY AND CHEMICAL PURITY FUELING ADOPTION IN SOLAR INDUSTRY 112

9.8 OTHERS END-USE INDUSTRIES 112

9.8.1 MEDICAL 113

9.8.2 RESEARCH 113

10 ULTRA-HIGH PURITY GRAPHITE MARKET, BY SOURCE 114

10.1 INTRODUCTION 115

10.2 SYNTHETIC GRAPHITE 116

10.2.1 DEMAND IN ENERGY STORAGE, SEMICONDUCTOR FABRICATION, AND OTHER HIGH-PRECISION APPLICATIONS TO DRIVE MARKET 116

10.3 NATURAL GRAPHITE 117

10.3.1 SUPERIOR CONDUCTIVITY AND HIGH-TEMPERATURE STABILITY DRIVING GROWTH 117

11 ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION 118

11.1 INTRODUCTION 119

11.2 NUCLEAR REACTORS 121

11.2.1 HIGH HEAT CONDUCTIVITY AND STRONG RADIATION RESISTANCE TO BOOST ADOPTION IN NUCLEAR REACTORS 121

11.3 LITHIUM-ION BATTERY ANODES 123

11.3.1 HIGH ENERGY STORAGE EFFICIENCY AND STRUCTURAL STABILITY INCREASING ADOPTION IN LITHIUM-ION BATTERIES 123

11.4 SEMICONDUCTORS 125

11.4.1 SUPERIOR PURITY AND PRECISION OF ULTRA-HIGH PURITY GRAPHITE TO DRIVE DEMAND IN SEMICONDUCTOR MANUFACTURING 125

11.5 OTHER APPLICATIONS 127

11.5.1 ELECTRIC ARC FURNACE ELECTRODES 127

11.5.2 THERMAL MANAGEMENT SYSTEMS 127

11.5.3 LUBRICANTS 128

11.5.4 CONDUCTIVE COATINGS 128

12 ULTRA-HIGH PURITY GRAPHITE MARKET, BY REGION 130

12.1 INTRODUCTION 131

12.2 ASIA PACIFIC 133

12.2.1 CHINA 137

12.2.1.1 Advancements in nuclear, semiconductor, and lithium-ion technologies fueling growth 137

12.2.2 INDIA 139

12.2.2.1 Favorable government initiatives driving market growth 139

12.2.3 JAPAN 141

12.2.3.1 Expansion of semiconductor sector and revival of nuclear power supporting market growth 141

12.2.4 AUSTRALIA 143

12.2.4.1 Nuclear policy advancement to drive market growth 143

12.2.5 REST OF ASIA PACIFIC 144

12.3 NORTH AMERICA 146

12.3.1 US 149

12.3.1.1 Semiconductor growth and nuclear energy expansion driving demand 149

12.3.2 CANADA 151

12.3.2.1 Expansion of nuclear and lithium projects accelerating demand 151

12.3.3 MEXICO 153

12.3.3.1 Semiconductor sector expansion and supportive government policies fueling market growth 153

12.4 EUROPE 155

12.4.1 GERMANY 159

12.4.1.1 Semiconductor and battery manufacturing expansion driving market growth 159

12.4.2 FRANCE 161

12.4.2.1 Nuclear energy expansion and favorable government policies strengthening market growth 161

12.4.3 SPAIN 163

12.4.3.1 Expansion of semiconductor sector supporting market growth 163

12.4.4 UK 165

12.4.4.1 Nuclear innovation and domestic supply development driving market growth 165

12.4.5 ITALY 167

12.4.5.1 Revival of nuclear energy and semiconductor expansion supporting market growth 167

12.4.6 REST OF EUROPE 169

12.5 MIDDLE EAST & AFRICA 171

12.5.1 GCC COUNTRIES 174

12.5.1.1 UAE 175

12.5.1.1.1 Nuclear sector expansion and semiconductor initiatives to drive demand 175

12.5.1.2 Saudi Arabia 177

12.5.1.2.1 Expansion of semiconductor and lithium-ion battery sectors driving growth 177

12.5.1.3 Rest of GCC Countries 179

12.5.2 SOUTH AFRICA 180

12.5.2.1 Expansion of nuclear power sector to drive demand 180

12.5.3 REST OF MIDDLE EAST & AFRICA 182

12.6 SOUTH AMERICA 184

12.6.1 BRAZIL 187

12.6.1.1 Nuclear expansion and semiconductor initiatives accelerating demand 187

12.6.2 ARGENTINA 189

12.6.2.1 Advancing nuclear innovation to drive demand during forecast period 189

12.6.3 REST OF SOUTH AMERICA 191

13 COMPETITIVE LANDSCAPE 193

13.1 INTRODUCTION 193

13.2 KEY PLAYERS’ STRATEGIES/RIGHT TO WIN 193

13.3 REVENUE ANALYSIS 195

13.4 MARKET SHARE ANALYSIS 196

13.4.1 RANKING OF KEY MARKET PLAYERS, 2024 196

13.4.2 MARKET SHARE OF KEY PLAYERS 196

13.5 BRAND/PRODUCT COMPARISON 199

13.5.1 MERSEN 200

13.5.2 TOYO TANSO CO., LTD. 200

13.5.3 SGL CARBON 200

13.5.4 GRAFTECH INTERNATIONAL 200

13.5.5 SUPERIOR GRAPHITE 200

13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 201

13.6.1 STARS 201

13.6.2 EMERGING LEADERS 201

13.6.3 PERVASIVE PLAYERS 201

13.6.4 PARTICIPANTS 201

13.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 203

13.6.5.1 Company footprint 203

13.6.5.2 Region footprint 204

13.6.5.3 Type footprint 205

13.6.5.4 Application footprint 206

13.6.5.5 Source footprint 207

13.6.5.6 End-use industry 208

13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024 209

13.7.1 PROGRESSIVE COMPANIES 209

13.7.2 RESPONSIVE COMPANIES 209

13.7.3 DYNAMIC COMPANIES 209

13.7.4 STARTING BLOCKS 209

13.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024 211

13.7.5.1 Detailed list of key startups/SMEs 211

13.7.5.2 Competitive benchmarking of key startups/SMEs 212

13.8 COMPETITIVE SCENARIO 212

13.8.1 DEALS 212

13.8.2 EXPANSIONS 214

13.9 COMPANY VALUATION AND FINANCIAL METRICS 215

14 COMPANY PROFILES 217

14.1 MAJOR PLAYERS 217

14.1.1 MERSEN 217

14.1.1.1 Business overview 217

14.1.1.2 Products/Solutions/Services offered 219

14.1.1.3 Recent developments 220

14.1.1.3.1 Deals 220

14.1.1.3.2 Expansions 221

14.1.1.4 MnM view 221

14.1.1.4.1 Right to win 221

14.1.1.4.2 Strategic choices 221

14.1.1.4.3 Weaknesses and competitive threats 222

14.1.2 TOYO TANSO CO., LTD. 223

14.1.2.1 Business overview 223

14.1.2.2 Products/Solutions/Services offered 225

14.1.2.3 MnM view 227

14.1.2.3.1 Right to win 227

14.1.2.3.2 Strategic choices 227

14.1.2.3.3 Weaknesses and competitive threats 227

14.1.3 SGL CARBON 228

14.1.3.1 Business overview 228

14.1.3.2 Products/Solutions/Services offered 230

14.1.3.3 MnM view 230

14.1.3.3.1 Right to win 230

14.1.3.3.2 Strategic choices 230

14.1.3.3.3 Weaknesses and competitive threats 231

14.1.4 ENTEGRIS 232

14.1.4.1 Business overview 232

14.1.4.2 Products/Solutions/Services offered 234

14.1.4.3 MnM view 238

14.1.4.3.1 Right to win 238

14.1.4.3.2 Strategic choices 238

14.1.4.3.3 Weaknesses and competitive threats 238

14.1.5 GRAFTECH INTERNATIONAL 239

14.1.5.1 Business overview 239

14.1.5.2 Products/Solutions/Services offered 240

14.1.5.3 MnM view 240

14.1.5.3.1 Right to win 240

14.1.5.3.2 Strategic choices 241

14.1.5.3.3 Weaknesses and competitive threats 241

14.1.6 CEYLON GRAPHITE CORP. 242

14.1.6.1 Business overview 242

14.1.6.2 Products/Solutions/Services offered 242

14.1.7 SUPERIOR GRAPHITE 243

14.1.7.1 Business overview 243

14.1.7.2 Products offered 243

14.1.7.3 Recent developments 244

14.1.7.3.1 Deals 244

14.1.7.3.2 Expansions 244

14.1.8 FOCUS GRAPHITE 245

14.1.8.1 Business overview 245

14.1.8.2 Products/Solutions/Services offered 245

14.1.9 SEC CARBON, LIMITED 246

14.1.9.1 Business overview 246

14.1.9.2 Products offered 246

14.1.10 ASBURY CARBONS 247

14.1.10.1 Business overview 247

14.1.10.2 Products/Solutions/Services offered 247

14.1.11 HPMS GRAPHITE 248

14.1.11.1 Business overview 248

14.1.11.2 Products/Solutions/Services offered 248

14.1.12 XRD GRAPHITE MANUFACTURING CO., LTD. 252

14.1.12.1 Business overview 252

14.1.12.2 Products/Solutions/Services offered 252

14.1.13 SARYTOGAN GRAPHITE LIMITED 253

14.1.13.1 Business overview 253

14.1.13.2 Products/Solutions/Services offered 253

14.1.14 AMSTED GRAPHITE MATERIALS 254

14.1.14.1 Business overview 254

14.1.14.2 Products/Solutions/Services offered 254

14.1.14.3 Recent developments 255

14.1.14.3.1 Deals 255

14.1.15 EAST CARBON 256

14.1.15.1 Business overview 256

14.1.15.2 Products/Solutions/Services offered 256

14.1.16 AMERICAN ELEMENTS 259

14.1.16.1 Business overview 259

14.1.16.2 Products/Solutions/Services offered 260

14.1.17 CANADA CARBON 261

14.1.17.1 Business overview 261

14.1.17.2 Products/Solutions/Services offered 262

14.1.18 ATLAS CRITICAL MINERALS 263

14.1.18.1 Business overview 263

14.1.18.2 Products/Solutions/Services offered 264

14.1.19 JINSUN NEW MATERIAL TECHNOLOGY, LTD. 265

14.1.19.1 Business overview 265

14.1.19.2 Products/Solutions/Services offered 266

14.2 OTHER PLAYERS 267

14.2.1 NINGBO RUIYI SEALING MATERIAL CO., LTD. 267

14.2.2 XURAN NEW MATERIALS LIMITED 268

14.2.3 CANGZHOU CARBON TECHNOLOGY CO., LTD. 269

14.2.4 CARBONIUM CORE 270

15 RESEARCH METHODOLOGY 271

15.1 RESEARCH DATA 271

15.1.1 SECONDARY DATA 272

15.1.1.1 Key data from secondary sources 272

15.1.2 PRIMARY DATA 272

15.1.2.1 Key data from primary sources 273

15.1.2.2 Breakdown of interviews with experts 273

15.2 DEMAND-SIDE ANALYSIS 274

15.3 MARKET SIZE ESTIMATION 274

15.3.1 BOTTOM-UP APPROACH 275

15.3.2 TOP-DOWN APPROACH 275

15.4 CALCULATION FOR SUPPLY-SIDE ANALYSIS 277

15.5 GROWTH FORECAST 277

15.6 DATA TRIANGULATION 277

15.7 RESEARCH ASSUMPTIONS 278

15.8 RESEARCH LIMITATIONS 279

15.9 RISK ASSESSMENT 279

16 APPENDIX 280

16.1 DISCUSSION GUIDE 280

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 282

16.3 CUSTOMIZATION OPTIONS 284

16.4 RELATED REPORTS 284

16.5 AUTHOR DETAILS 285

LIST OF TABLES

TABLE 1 ULTRA-HIGH PURITY GRAPHITE MARKET: PORTER’S FIVE FORCES ANALYSIS 51

TABLE 2 GDP PERCENTAGE CHANGE, BY KEY COUNTRIES, 2021–2029 53

TABLE 3 ULTRA-HIGH PURITY GRAPHITE MARKET: ROLE OF COMPANIES IN ECOSYSTEM 59

TABLE 4 AVERAGE SELLING PRICE OF ULTRA-HIGH PURITY GRAPHITE IN TOP APPLICATIONS, BY KEY PLAYERS, 2024 (USD/TON) 60

TABLE 5 AVERAGE SELLING PRICE TREND OF ULTRA-HIGH PURITY GRAPHITE, BY REGION, 2022–2024 (USD/TON) 61

TABLE 6 IMPORT DATA FOR HS CODE 380110-COMPLIANT PRODUCTS,

2020–2024 (USD THOUSAND) 63

TABLE 7 EXPORT DATA FOR HS CODE 380110-COMPLIANT PRODUCTS,

2020–2024 (USD THOUSAND) 64

TABLE 8 ULTRA-HIGH PURITY GRAPHITE MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025–2026 65

TABLE 9 US-ADJUSTED RECIPROCAL TARIFF RATES 70

TABLE 10 ULTRA-HIGH PURITY GRAPHITE MARKET: TOTAL NUMBER OF PATENTS,

2014–2024 80

TABLE 11 TOP USE CASES AND MARKET POTENTIAL 88

TABLE 12 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES 89

TABLE 13 ULTRA-HIGH PURITY GRAPHITE MARKET: CASE STUDIES RELATED TO

GEN AI IMPLEMENTATION 89

TABLE 14 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS 90

TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 92

TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 93

TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 93

TABLE 18 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 93

TABLE 19 GLOBAL STANDARDS IN ULTRA-HIGH PURITY GRAPHITE MARKET 94

TABLE 20 CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN ULTRA-HIGH PURITY GRAPHITE MARKET 96

TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY (%) 99

TABLE 22 KEY BUYING CRITERIA, BY END-USE INDUSTRY 100

TABLE 23 ULTRA-HIGH PURITY GRAPHITE MARKET: UNMET NEEDS IN KEY END-USE INDUSTRIES 103

TABLE 24 ULTRA-HIGH PURITY GRAPHITE MARKET, BY SOURCE, 2022–2024 (KILOTON) 115

TABLE 25 ULTRA-HIGH PURITY GRAPHITE MARKET, BY SOURCE, 2025–2030 (KILOTON) 115

TABLE 26 ULTRA-HIGH PURITY SYNTHETIC GRAPHITE MARKET, BY REGION,

2022–2024 (KILOTON) 116

TABLE 27 ULTRA-HIGH PURITY SYNTHETIC GRAPHITE MARKET, BY REGION,

2025–2030 (KILOTON) 116

TABLE 28 ULTRA-HIGH PURITY NATURAL GRAPHITE MARKET, BY REGION,

2022–2024 (KILOTON) 117

TABLE 29 ULTRA-HIGH PURITY NATURAL GRAPHITE MARKET, BY REGION,

2025–2030 (KILOTON) 117

TABLE 30 ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 119

TABLE 31 ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 120

TABLE 32 ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION, 2022–2024 (KILOTON) 120

TABLE 33 ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION, 2025–2030 (KILOTON) 120

TABLE 34 ULTRA-HIGH PURITY GRAPHITE MARKET IN NUCLEAR REACTORS, BY REGION, 2022–2024 (USD MILLION) 121

TABLE 35 ULTRA-HIGH PURITY GRAPHITE MARKET IN NUCLEAR REACTORS, BY REGION, 2025–2030 (USD MILLION) 122

TABLE 36 ULTRA-HIGH PURITY GRAPHITE MARKET IN NUCLEAR REACTORS, BY REGION, 2022–2024 (KILOTON) 122

TABLE 37 ULTRA-HIGH PURITY GRAPHITE MARKET IN NUCLEAR REACTORS, BY REGION, 2025–2030 (KILOTON) 122

TABLE 38 ULTRA-HIGH PURITY GRAPHITE MARKET IN LITHIUM-ION BATTERY ANODES,

BY REGION, 2022–2024 (USD MILLION) 123

TABLE 39 ULTRA-HIGH PURITY GRAPHITE MARKET IN LITHIUM-ION BATTERY ANODES,

BY REGION, 2025–2030 (USD MILLION) 124

TABLE 40 ULTRA-HIGH PURITY GRAPHITE MARKET IN LITHIUM-ION BATTERY ANODES,

BY REGION, 2022–2024 (KILOTON) 124

TABLE 41 ULTRA-HIGH PURITY GRAPHITE MARKET IN LITHIUM-ION BATTERY ANODES,

BY REGION, 2025–2030 (KILOTON) 124

TABLE 42 ULTRA-HIGH PURITY GRAPHITE MARKET IN SEMICONDUCTORS, BY REGION, 2022–2024 (USD MILLION) 125

TABLE 43 ULTRA-HIGH PURITY GRAPHITE MARKET IN SEMICONDUCTORS, BY REGION, 2025–2030 (USD MILLION) 126

TABLE 44 ULTRA-HIGH PURITY GRAPHITE MARKET IN SEMICONDUCTORS, BY REGION, 2022–2024 (KILOTON) 126

TABLE 45 ULTRA-HIGH PURITY GRAPHITE MARKET IN SEMICONDUCTORS, BY REGION, 2025–2030 (KILOTON) 126

TABLE 46 ULTRA-HIGH PURITY GRAPHITE MARKET IN OTHER APPLICATIONS, BY REGION, 2022–2024 (USD MILLION) 128

TABLE 47 ULTRA-HIGH PURITY GRAPHITE MARKET IN OTHER APPLICATIONS, BY REGION, 2025–2030 (USD MILLION) 129

TABLE 48 ULTRA-HIGH PURITY GRAPHITE MARKET IN OTHER APPLICATIONS, BY REGION, 2022–2024 (KILOTON) 129

TABLE 49 ULTRA-HIGH PURITY GRAPHITE MARKET IN OTHER APPLICATIONS, BY REGION, 2025–2030 (KILOTON) 129

TABLE 50 ULTRA-HIGH PURITY GRAPHITE MARKET, BY REGION, 2022–2024 (USD MILLION) 131

TABLE 51 ULTRA-HIGH PURITY GRAPHITE MARKET, BY REGION, 2025–2030 (USD MILLION) 132

TABLE 52 ULTRA-HIGH PURITY GRAPHITE MARKET, BY REGION, 2022–2024 (KILOTON) 132

TABLE 53 ULTRA-HIGH PURITY GRAPHITE MARKET, BY REGION, 2025–2030 (KILOTON) 132

TABLE 54 ASIA PACIFIC: ULTRA-HIGH PURITY GRAPHITE MARKET, BY COUNTRY,

2022–2024 (USD MILLION) 134

TABLE 55 ASIA PACIFIC: ULTRA-HIGH PURITY GRAPHITE MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 134

TABLE 56 ASIA PACIFIC: ULTRA-HIGH PURITY GRAPHITE MARKET, BY COUNTRY,

2022–2024 (KILOTON) 134

TABLE 57 ASIA PACIFIC: ULTRA-HIGH PURITY GRAPHITE MARKET, BY COUNTRY,

2025–2030 (KILOTON) 135

TABLE 58 ASIA PACIFIC: ULTRA-HIGH PURITY GRAPHITE MARKET, BY SOURCE,

2022–2024 (KILOTON) 135

TABLE 59 ASIA PACIFIC: ULTRA-HIGH PURITY GRAPHITE MARKET, BY SOURCE,

2025–2030 (KILOTON) 135

TABLE 60 ASIA PACIFIC: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 135

TABLE 61 ASIA PACIFIC: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 136

TABLE 62 ASIA PACIFIC: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (KILOTON) 136

TABLE 63 ASIA PACIFIC: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (KILOTON) 136

TABLE 64 CHINA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 137

TABLE 65 CHINA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 138

TABLE 66 CHINA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (KILOTON) 138

TABLE 67 CHINA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (KILOTON) 138

TABLE 68 INDIA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 139

TABLE 69 INDIA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 140

TABLE 70 INDIA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (KILOTON) 140

TABLE 71 INDIA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (KILOTON) 140

TABLE 72 JAPAN: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 141

TABLE 73 JAPAN: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 142

TABLE 74 JAPAN: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (KILOTON) 142

TABLE 75 JAPAN: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (KILOTON) 142

TABLE 76 AUSTRALIA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 143

TABLE 77 AUSTRALIA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 143

TABLE 78 AUSTRALIA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (KILOTON) 144

TABLE 79 AUSTRALIA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (KILOTON) 144

TABLE 80 REST OF ASIA PACIFIC: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION, 2022–2024 (USD MILLION) 145

TABLE 81 REST OF ASIA PACIFIC: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 145

TABLE 82 REST OF ASIA PACIFIC: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION, 2022–2024 (KILOTON) 145

TABLE 83 REST OF ASIA PACIFIC: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION, 2025–2030 (KILOTON) 146

TABLE 84 NORTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY COUNTRY,

2022–2024 (USD MILLION) 147

TABLE 85 NORTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 147

TABLE 86 NORTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY COUNTRY,

2022–2024 (KILOTON) 147

TABLE 87 NORTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY COUNTRY,

2025–2030 (KILOTON) 147

TABLE 88 NORTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY SOURCE,

2022–2024 (KILOTON) 148

TABLE 89 NORTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY SOURCE,

2025–2030 (KILOTON) 148

TABLE 90 NORTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION, 2022–2024 (USD MILLION) 148

TABLE 91 NORTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 148

TABLE 92 NORTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION, 2022–2024 (KILOTON) 149

TABLE 93 NORTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION, 2025–2030 (KILOTON) 149

TABLE 94 US: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 150

TABLE 95 US: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 150

TABLE 96 US: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (KILOTON) 150

TABLE 97 US: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (KILOTON) 151

TABLE 98 CANADA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 152

TABLE 99 CANADA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 152

TABLE 100 CANADA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (KILOTON) 152

TABLE 101 CANADA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (KILOTON) 153

TABLE 102 MEXICO: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 154

TABLE 103 MEXICO: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 154

TABLE 104 MEXICO: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (KILOTON) 154

TABLE 105 MEXICO: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (KILOTON) 155

TABLE 106 EUROPE: ULTRA-HIGH PURITY GRAPHITE MARKET, BY COUNTRY,

2022–2024 (USD MILLION) 156

TABLE 107 EUROPE: ULTRA-HIGH PURITY GRAPHITE MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 157

TABLE 108 EUROPE: ULTRA-HIGH PURITY GRAPHITE MARKET, BY COUNTRY,

2022–2024 (KILOTON) 157

TABLE 109 EUROPE: ULTRA-HIGH PURITY GRAPHITE MARKET, BY COUNTRY,

2025–2030 (KILOTON) 157

TABLE 110 EUROPE: ULTRA-HIGH PURITY GRAPHITE MARKET, BY SOURCE,

2022–2024 (KILOTON) 158

TABLE 111 EUROPE: ULTRA-HIGH PURITY GRAPHITE MARKET, BY SOURCE,

2025–2030 (KILOTON) 158

TABLE 112 EUROPE: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 158

TABLE 113 EUROPE: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 158

TABLE 114 EUROPE: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (KILOTON) 159

TABLE 115 EUROPE: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (KILOTON) 159

TABLE 116 GERMANY: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 160

TABLE 117 GERMANY: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 160

TABLE 118 GERMANY: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (KILOTON) 161

TABLE 119 GERMANY: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (KILOTON) 161

TABLE 120 FRANCE: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 162

TABLE 121 FRANCE: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 162

TABLE 122 FRANCE: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (KILOTON) 163

TABLE 123 FRANCE: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (KILOTON) 163

TABLE 124 SPAIN: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 164

TABLE 125 SPAIN: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 164

TABLE 126 SPAIN: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (KILOTON) 164

TABLE 127 SPAIN: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (KILOTON) 165

TABLE 128 UK: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 166

TABLE 129 UK: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 166

TABLE 130 UK: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (KILOTON) 166

TABLE 131 UK: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (KILOTON) 167

TABLE 132 ITALY: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 168

TABLE 133 ITALY: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 168

TABLE 134 ITALY: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (KILOTON) 168

TABLE 135 ITALY: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (KILOTON) 169

TABLE 136 REST OF EUROPE: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION, 2022–2024 (USD MILLION) 169

TABLE 137 REST OF EUROPE: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 170

TABLE 138 REST OF EUROPE: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION, 2022–2024 (KILOTON) 170

TABLE 139 REST OF EUROPE: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION, 2025–2030 (KILOTON) 170

TABLE 140 MIDDLE EAST & AFRICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY COUNTRY, 2022–2024 (USD MILLION) 171

TABLE 141 MIDDLE EAST & AFRICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 171

TABLE 142 MIDDLE EAST & AFRICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY COUNTRY, 2022–2024 (KILOTON) 172

TABLE 143 MIDDLE EAST & AFRICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY COUNTRY, 2025–2030 (KILOTON) 172

TABLE 144 MIDDLE EAST & AFRICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY SOURCE, 2022–2024 (KILOTON) 172

TABLE 145 MIDDLE EAST & AFRICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY SOURCE, 2025–2030 (KILOTON) 173

TABLE 146 MIDDLE EAST & AFRICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION, 2022–2024 (USD MILLION) 173

TABLE 147 MIDDLE EAST & AFRICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 173

TABLE 148 MIDDLE EAST & AFRICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION, 2022–2024 (KILOTON) 174

TABLE 149 MIDDLE EAST & AFRICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION, 2025–2030 (KILOTON) 174

TABLE 150 UAE: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 175

TABLE 151 UAE: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 176

TABLE 152 UAE: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (KILOTON) 176

TABLE 153 UAE: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (KILOTON) 176

TABLE 154 SAUDI ARABIA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 177

TABLE 155 SAUDI ARABIA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 178

TABLE 156 SAUDI ARABIA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (KILOTON) 178

TABLE 157 SAUDI ARABIA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (KILOTON) 178

TABLE 158 REST OF GCC: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 179

TABLE 159 REST OF GCC: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 179

TABLE 160 REST OF GCC: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (KILOTON) 180

TABLE 161 REST OF GCC: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (KILOTON) 180

TABLE 162 SOUTH AFRICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 181

TABLE 163 SOUTH AFRICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 181

TABLE 164 SOUTH AFRICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (KILOTON) 181

TABLE 165 SOUTH AFRICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (KILOTON) 182

TABLE 166 REST OF MIDDLE EAST & AFRICA: ULTRA-HIGH PURITY GRAPHITE MARKET,

BY APPLICATION, 2022–2024 (USD MILLION) 182

TABLE 167 REST OF MIDDLE EAST & AFRICA: ULTRA-HIGH PURITY GRAPHITE MARKET,

BY APPLICATION, 2025–2030 (USD MILLION) 183

TABLE 168 REST OF MIDDLE EAST & AFRICA: ULTRA-HIGH PURITY GRAPHITE MARKET,

BY APPLICATION, 2022–2024 (KILOTON) 183

TABLE 169 REST OF MIDDLE EAST & AFRICA: ULTRA-HIGH PURITY GRAPHITE MARKET,

BY APPLICATION, 2025–2030 (KILOTON) 183

TABLE 170 SOUTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY COUNTRY,

2022–2024 (USD MILLION) 184

TABLE 171 SOUTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 184

TABLE 172 SOUTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY COUNTRY,

2022–2024 (KILOTON) 185

TABLE 173 SOUTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY COUNTRY,

2025–2030 (KILOTON) 185

TABLE 174 SOUTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY SOURCE,

2022–2024 (KILOTON) 185

TABLE 175 SOUTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY SOURCE,

2025–2030 (KILOTON) 185

TABLE 176 SOUTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION, 2022–2024 (USD MILLION) 186

TABLE 177 SOUTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 186

TABLE 178 SOUTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION, 2022–2024 (KILOTON) 186

TABLE 179 SOUTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION, 2025–2030 (KILOTON) 187

TABLE 180 BRAZIL: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 188

TABLE 181 BRAZIL: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 188

TABLE 182 BRAZIL: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (KILOTON) 188

TABLE 183 BRAZIL: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (KILOTON) 189

TABLE 184 ARGENTINA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 189

TABLE 185 ARGENTINA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 190

TABLE 186 ARGENTINA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2022–2024 (KILOTON) 190

TABLE 187 ARGENTINA: ULTRA-HIGH PURITY GRAPHITE MARKET, BY APPLICATION,

2025–2030 (KILOTON) 190

TABLE 188 REST OF SOUTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET,

BY APPLICATION, 2022–2024 (USD MILLION) 191

TABLE 189 REST OF SOUTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET,

BY APPLICATION, 2025–2030 (USD MILLION) 191

TABLE 190 REST OF SOUTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET,

BY APPLICATION, 2022–2024 (KILOTON) 192

TABLE 191 REST OF SOUTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET,

BY APPLICATION, 2025–2030 (KILOTON) 192

TABLE 192 ULTRA-HIGH PURITY GRAPHITE MARKET: OVERVIEW OF STRATEGIES ADOPTED

BY KEY PLAYERS, 2020–2025 194

TABLE 193 ULTRA-HIGH PURITY GRAPHITE MARKET: DEGREE OF COMPETITION, 2024 197

TABLE 194 ULTRA-HIGH PURITY GRAPHITE MARKET: REGION FOOTPRINT 204

TABLE 195 ULTRA-HIGH PURITY GRAPHITE MARKET: TYPE FOOTPRINT 205

TABLE 196 ULTRA-HIGH PURITY GRAPHITE MARKET: APPLICATION FOOTPRINT 206

TABLE 197 ULTRA-HIGH PURITY GRAPHITE MARKET: SOURCE FOOTPRINT 207

TABLE 198 ULTRA-HIGH PURITY GRAPHITE MARKET: END-USE INDUSTRY FOOTPRINT 208

TABLE 199 ULTRA-HIGH PURITY GRAPHITE MARKET: DETAILED LIST OF KEY STARTUPS/SMES 211

TABLE 200 ULTRA-HIGH PURITY GRAPHITE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES 212

TABLE 201 ULTRA-HIGH PURITY GRAPHITE MARKET: DEALS,

JANUARY 2020–NOVEMBER 2025 213

TABLE 202 ULTRA-HIGH PURITY GRAPHITE MARKET: EXPANSIONS,

JANUARY 2020–NOVEMBER 2025 214

TABLE 203 MERSEN: COMPANY OVERVIEW 217

TABLE 204 MERSEN: PRODUCTS/SOLUTIONS/SERVICES OFFERED 219

TABLE 205 MERSEN: DEALS 220

TABLE 206 MERSEN: EXPANSIONS 221

TABLE 207 TOYO TANSO CO., LTD.: COMPANY OVERVIEW 223

TABLE 208 TOYO TANSO CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 225

TABLE 209 SGL CARBON: COMPANY OVERVIEW 228

TABLE 210 SGL CARBON: PRODUCTS/SOLUTIONS/SERVICES OFFERED 230

TABLE 211 ENTEGRIS: COMPANY OVERVIEW 232

TABLE 212 ENTEGRIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED 234

TABLE 213 GRAFTECH INTERNATIONAL: COMPANY OVERVIEW 239

TABLE 214 GRAFTECH INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED 240

TABLE 215 CEYLON GRAPHITE CORP.: COMPANY OVERVIEW 242

TABLE 216 CEYLON GRAPHITE CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 242

TABLE 217 SUPERIOR GRAPHITE: COMPANY OVERVIEW 243

TABLE 218 SUPERIOR GRAPHITE: PRODUCTS/SOLUTIONS/SERVICES OFFERED 243

TABLE 219 SUPERIOR GRAPHITE: DEALS 244

TABLE 220 SUPERIOR GRAPHITE: EXPANSIONS 244

TABLE 221 FOCUS GRAPHITE: COMPANY OVERVIEW 245

TABLE 222 FOCUS GRAPHITE: PRODUCTS/SOLUTIONS/SERVICES OFFERED 245

TABLE 223 SEC CARBON, LIMITED: COMPANY OVERVIEW 246

TABLE 224 SEC CARBON, LIMITED.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 246

TABLE 225 ASBURY CARBONS: COMPANY OVERVIEW 247

TABLE 226 ASBURY CARBONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED 247

TABLE 227 HPMS GRAPHITE: COMPANY OVERVIEW 248

TABLE 228 HPMS GRAPHITE: PRODUCTS/SOLUTIONS/SERVICES OFFERED 248

TABLE 229 XRD GRAPHITE MANUFACTURING CO., LTD.: COMPANY OVERVIEW 252

TABLE 230 XRD GRAPHITE MANUFACTURING CO., LTD.: PRODUCTS/SOLUTIONS/

SERVICES OFFERED 252

TABLE 231 SARYTOGAN GRAPHITE LIMITED.: COMPANY OVERVIEW 253

TABLE 232 SARYTOGAN GRAPHITE LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED 253

TABLE 233 AMSTED GRAPHITE MATERIALS: COMPANY OVERVIEW 254

TABLE 234 AMSTED GRAPHITE MATERIALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED 254

TABLE 235 AMSTED GRAPHITE MATERIALS: DEALS 255

TABLE 236 EAST CARBON: COMPANY OVERVIEW 256

TABLE 237 EAST CARBON: PRODUCTS/SOLUTIONS/SERVICES OFFERED 256

TABLE 238 AMERICAN ELEMENTS: COMPANY OVERVIEW 259

TABLE 239 AMERICAN ELEMENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED 260

TABLE 240 CANADA CARBON: COMPANY OVERVIEW 261

TABLE 241 CANADA CARBON: PRODUCTS/SOLUTIONS/SERVICES OFFERED 262

TABLE 242 ATLAS CRITICAL MINERALS: COMPANY OVERVIEW 263

TABLE 243 ATLAS CRITICAL MINERALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED 264

TABLE 244 JINSUN NEW MATERIAL TECHNOLOGY, LTD.: COMPANY OVERVIEW 265

TABLE 245 JINSUN NEW MATERIAL TECHNOLOGY, LTD.: PRODUCTS/SOLUTIONS/

SERVICES OFFERED 266

TABLE 246 NINGBO RUIYI SEALING MATERIAL CO., LTD.: COMPANY OVERVIEW 267

TABLE 247 XURAN NEW MATERIALS LIMITED: COMPANY OVERVIEW 268

TABLE 248 CANGZHOU CARBON TECHNOLOGY CO., LTD.: COMPANY OVERVIEW 269

TABLE 249 CARBONIUM CORE: COMPANY OVERVIEW 270

LIST OF FIGURES

FIGURE 1 ULTRA-HIGH PURITY GRAPHITE MARKET SEGMENTATION AND REGIONAL SCOPE 28

FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS 31

FIGURE 3 GLOBAL ULTRA-HIGH PURITY GRAPHITE MARKET, 2025–2030 32

FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN ULTRA-HIGH PURITY GRAPHITE MARKET (2020–2025) 32

FIGURE 5 DISRUPTIVE TRENDS IMPACTING GROWTH OF ULTRA-HIGH PURITY GRAPHITE MARKET 33

FIGURE 6 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN ULTRA-HIGH PURITY GRAPHITE MARKET, 2024 34

FIGURE 7 NORTH AMERICA TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD 35

FIGURE 8 HIGH DEMAND IN LITHIUM-ION BATTERY ANODES TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS 36

FIGURE 9 SYNTHETIC SEGMENT ACCOUNTED FOR DOMINANT MARKET SHARE IN 2024 37

FIGURE 10 LITHIUM-ION BATTERY ANODES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024 37

FIGURE 11 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD 38

FIGURE 12 ULTRA-HIGH PURITY GRAPHITE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES 40

FIGURE 13 EV BATTERY DEMAND FROM 2021 TO 2023 (GWH) 41

FIGURE 14 PROJECTED EV BATTERY DEMAND FROM 2024 TO 2030 (TWH) 41

FIGURE 15 GLOBAL SEMICONDUCTOR MARKET SIZE, 2023 TO 2O26 42

FIGURE 16 GLOBAL PV CUMULATIVE SUPPLY, 2022–2024 (TW) 43

FIGURE 17 GLOBAL NUCLEAR POWER CAPACITY TREND, 2005 TO 2024 45

FIGURE 18 ULTRA-HIGH PURITY GRAPHITE MARKET: PORTER’S FIVE FORCES ANALYSIS 50

FIGURE 19 ULTRA-HIGH PURITY GRAPHITE MARKET: VALUE CHAIN ANALYSIS 56

FIGURE 20 ULTRA-HIGH PURITY GRAPHITE MARKET: KEY PARTICIPANTS IN ECOSYSTEM 58

FIGURE 21 ULTRA-HIGH PURITY GRAPHITE MARKET: ECOSYSTEM ANALYSIS 58

FIGURE 22 AVERAGE SELLING PRICE, BY APPLICATION 60

FIGURE 23 AVERAGE SELLING PRICE TREND, BY REGION, 2022–2024 61

FIGURE 24 IMPORT SCENARIO FOR HS CODE 380110-COMPLIANT PRODUCTS,

BY KEY COUNTRIES, 2020–2024 63

FIGURE 25 EXPORT SCENARIO FOR HS CODE 380110-COMPLIANT PRODUCTS,

BY KEY COUNTRIES, 2020–2024 64

FIGURE 26 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS 66

FIGURE 27 ULTRA-HIGH PURITY GRAPHITE MARKET: INVESTMENT AND FUNDING

SCENARIO, 2024 67

FIGURE 28 PATENT ANALYSIS, BY DOCUMENT TYPE, 2014–2024 80

FIGURE 29 PATENT PUBLICATION TRENDS, 2014 – 2024 81

FIGURE 30 LEGAL STATUS OF PATENT, 2014–2024 81

FIGURE 31 JURISDICTION OF CHINA REGISTERED HIGHEST SHARE OF PATENTS, 2014–2024 82

FIGURE 32 TOP PATENT APPLICANTS, 2014–2024 83

FIGURE 33 FUTURE APPLICATIONS OF ULTRA-HIGH PURITY GRAPHITE 86

FIGURE 34 ULTRA-HIGH PURITY GRAPHITE MARKET: DECISION-MAKING FACTORS 98

FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY 99

FIGURE 36 KEY BUYING CRITERIA, BY END-USE INDUSTRY 100

FIGURE 37 ADOPTION BARRIERS & INTERNAL CHALLENGES 102

FIGURE 38 SYNTHETIC SEGMENT TO DOMINATE ULTRA-HIGH PURITY GRAPHITE MARKET 115

FIGURE 39 LITHIUM-ION BATTERY ANODES TO BE LARGEST APPLICATION OF ULTRA-HIGH PURITY GRAPHITE DURING FORECAST PERIOD 119

FIGURE 40 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030 131

FIGURE 41 ASIA PACIFIC: ULTRA-HIGH PURITY GRAPHITE MARKET SNAPSHOT 133

FIGURE 42 NORTH AMERICA: ULTRA-HIGH PURITY GRAPHITE MARKET SNAPSHOT 146

FIGURE 43 EUROPE: ULTRA-HIGH PURITY GRAPHITE MARKET SNAPSHOT 156

FIGURE 44 ULTRA-HIGH PURITY GRAPHITE MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2020–2024 195

FIGURE 45 RANKING OF KEY PLAYERS IN ULTRA-HIGH PURITY GRAPHITE MARKET 196

FIGURE 46 ULTRA-HIGH PURITY GRAPHITE MARKET SHARE ANALYSIS, 2024 196

FIGURE 47 ULTRA-HIGH PURITY GRAPHITE MARKET: BRAND/PRODUCT COMPARISON 199

FIGURE 48 ULTRA-HIGH PURITY GRAPHITE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024 202

FIGURE 49 ULTRA-HIGH PURITY GRAPHITE MARKET: COMPANY FOOTPRINT 203

FIGURE 50 ULTRA-HIGH PURITY GRAPHITE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024 210

FIGURE 51 ULTRA-HIGH PURITY GRAPHITE MARKET: EV/EBITDA 215

FIGURE 52 ULTRA-HIGH PURITY GRAPHITE MARKET: ENTERPRISE VALUE 216

FIGURE 53 ULTRA-HIGH PURITY GRAPHITE MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS 216

FIGURE 54 MERSEN: COMPANY SNAPSHOT 218

FIGURE 55 TOYO TANSO CO., LTD.: COMPANY SNAPSHOT 224

FIGURE 56 SGL CARBON: COMPANY SNAPSHOT 229

FIGURE 57 ENTEGRIS: COMPANY SNAPSHOT 233

FIGURE 58 GRAFTECH INTERNATIONAL: COMPANY SNAPSHOT 239

FIGURE 59 ULTRA-HIGH PURITY GRAPHITE MARKET: RESEARCH DESIGN 271

FIGURE 60 DEMAND-SIDE ANALYSIS FOR ULTRA-HIGH PURITY GRAPHITE MARKET 274

FIGURE 61 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH 275

FIGURE 62 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH 275

FIGURE 63 METHODOLOGY FOR SUPPLY-SIDE SIZING OF ULTRA-HIGH PURITY GRAPHITE MARKET (1/2) 276

FIGURE 64 METHODOLOGY FOR SUPPLY-SIDE SIZING OF ULTRA-HIGH PURITY GRAPHITE MARKET (2/2) 276

FIGURE 65 ULTRA-HIGH PURITY GRAPHITE MARKET: DATA TRIANGULATION 278