Telecom Cloud - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

テレコムクラウド市場は、タイプ(ソリューション、サービスなど)、アプリケーション(課金とプロビジョニング、トラフィック管理など)、クラウドプラットフォーム(SaaS、Iaas、PaaS)、エンドユーザー(BFSI、小売、製造など)、および地域別にセグメント化されています。

The Telecom Cloud Market is Segmented by Type (Solution, Services, and More), Application (Billing and Provisioning, Traffic Management, and More), Cloud Platform (SaaS, Iaas, and PaaS), End User (BFSI, Retail, Manufacturing, and More) and by Geography.

| 出版 | Mordor Intelligence |

| 出版年月 | 2025年06月 |

| ページ数 | 120 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,750 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-12343 |

テレコムクラウド市場規模は、2025年には313.4億米ドルに達すると推定され、2030年には1,059.3億米ドルに達し、年平均成長率(CAGR)27.58%で成長すると予測されています。通信事業者は、5Gの収益化、エッジコンピューティングの加速、運用コストの圧縮を実現するクラウドネイティブ・コアネットワークに資金を投入しています。Open RANの導入、ネットワーク機能の仮想化、ハイブリッドクラウドの採用といったトレンドが融合し、接続の設計と販売方法に変化をもたらしています。AT&TとEricssonが締結した140億米ドル規模のOpen RAN契約などの支出コミットメントは、この移行の規模の大きさを浮き彫りにしています。VodafoneとMicrosoftが締結した15億米ドル規模の契約は、マルチクラウド・フレームワークがパフォーマンス、主権、コンプライアンスの期待に応える方法を示しています。Verizonのマルチアクセス・エッジコンピューティング試験では、レイテンシを半減させ、エッジクラウド・フェデレーションが通信事業者をインダストリー4.0の収益源として位置づける好例となっています。

2024年にはソリューションセグメントが53.6%のシェアを占め、通信事業者が基盤となるクラウドスタックに注力する第一波を反映しています。一方、サービスは年平均成長率27.7%で成長を加速させており、通信事業者が専門パートナーに運用をアウトソースするにつれて、その差は縮まると予測されています。ユニファイドコミュニケーション、CDN、セキュリティワークロードは引き続きソリューションの収益を押し上げていますが、マネージドホスティング、プロフェッショナルサービス、ネットワーク・アズ・ア・サービス契約の成長が加速しています。

Telecom Cloud Market Analysis

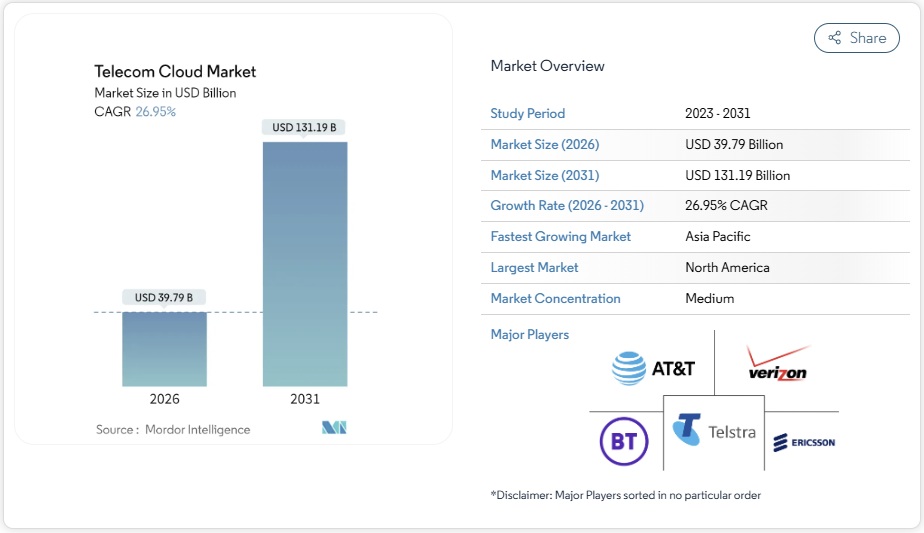

The telecom cloud market size is estimated at USD 31.34 billion in 2025 and is forecast to reach USD 105.93 billion by 2030, advancing at a 27.58% CAGR. Operators are steering capital toward cloud-native core networks that unlock 5G monetization, accelerate edge computing, and compress operating costs. Converging trends—Open RAN deployment, network-functions virtualization, and hybrid-cloud adoption—are altering how connectivity is engineered and sold. Spending commitments such as AT&T’s USD 14 billion Open RAN deal with Ericsson underscore the scale of transition. Vodafone’s USD 1.5 billion pact with Microsoft highlights how multi-cloud frameworks address performance, sovereignty, and compliance expectations. Verizon’s multi-access edge computing trials cutting latency in half exemplify how edge-cloud federation positions carriers for Industry 4.0 revenue pools.

Global Telecom Cloud Market Trends and Insights

Surge in 5G roll-outs demanding cloud-native core networks

Standalone 5G mandates cloud-native cores, dismantling monolithic architectures in favor of micro-services that enable automated network slicing and real-time provisioning. Deutsche Telekom’s work with Google Cloud on AI-driven RAN orchestration proves that automation is now indispensable to manage the scale and complexity of 5G traffic. Telefónica Germany migrated 45 million subscribers to Ericsson’s cloud-native 5G core, cutting service-activation times and fortifying network agility.These transformations signal that 5G revenue relies on cloud-native capabilities deployed at carrier grade.

Growing adoption of hybrid and multi-cloud by telecom operators

Rakuten Symphony’s multi-cloud blueprint showcases workload portability across providers while guarding sovereignty obligations. Hybrid architectures allow latency-sensitive network functions to remain on-premise while scalable workloads burst to public clouds. Cisco finds 82% of enterprises now run hybrid models, validating the strategy for resilience and cost optimization. This dual-environment adoption is accelerating as operators link compliance with innovation velocity.

Data-sovereignty and security compliance hurdles

Google Cloud’s telecom-specific compliance frameworks attest to the maze of regional privacy rules carriers must meet. Localization mandates inflate compute costs by up to 60%, eroding the telecom cloud market’s cost-saving allure. VMware sovereign-cloud blueprints show architecture complexity rises when carriers enforce in-country residency and encryption at rest. Evolving statutes constrain deployment flexibility and lengthen project timelines.

Other drivers and restraints analyzed in the detailed report include:

- Edge-cloud federation enabling ultra-low-latency enterprise 4.0

- Convergence of Open RAN accelerating RAN-cloudification

- Integration complexity with legacy BSS/OSS stacks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024 solution segment held 53.6% share, reflecting operators’ first-wave focus on foundational cloud stacks. Yet Services are accelerating at a 27.7% CAGR, forecast to close the gap as carriers outsource operations to specialist partners. Unified communication, CDN, and security workloads continue to lift Solution revenues, but managed hosting, professional services, and network-as-a-service contracts are growing faster.

Operators increasingly adopt managed models to de-risk transformation and redeploy staff toward customer innovation. Colocation footprints give carriers proximity to edge zones, while professional-service engagements address skills shortages. This trend signals a structural shift toward opex-based consumption, aligning telco spending with traffic elasticity and subscriber seasonality across the telecom cloud market.

Billing and Provisioning retained 45.7% of telecom cloud market size in 2024, underpinning revenue assurance activities critical to every carrier. Traffic Management, however, is projected to grow 28.1% annually as 5G data surges strain networks. Cisco’s Ultra Traffic Optimization and Opanga’s RAIN AI showcase AI-driven congestion relief that boosts QoE without fresh spectrum buys.

AI-infused engines that predict congestion and reroute packets in real time are becoming must-have capabilities. HCL’s Augmented Network Automation illustrates 20% capacity lifts alongside OPEX cuts, explaining the outsized growth. Ancillary workloads such as security analytics and customer-experience portals also migrate to cloud in lockstep, reinforcing application-layer diversification within the telecom cloud market.

Telecom Cloud Market is Segmented by Type (Solution, Services, and Other Types), Application (Billing and Provisioning, Traffic Management, and More), Cloud Platform (SaaS, Iaas, and PaaS), End User (BFSI, Retail, Manufacturing, and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 35.3% revenue in 2024 as early 5G roll-outs, established hyperscaler partnerships, and favorable regulations aligned. Carriers monetized edge services and enterprise connectivity, strengthening regional leadership in the telecom cloud market. Federal funding streams for rural 5G also bolster investment momentum.

Asia-Pacific is projected to expand at 27.3% CAGR through 2030, supported by government digitalization programs and massive data-center investments. AWS’s USD 15 billion commitment and Microsoft’s USD 2.9 billion plan in Japan illustrate capital intensity, while Huawei’s 77% cloud-service revenue jump in 2023 signals domestic demand acceleration. China’s USD 9.2 billion 2023 cloud-infrastructure spend positions its carriers and local providers for growth.

Europe remains a sizeable market, where stringent sovereignty mandates foster sovereign-cloud builds and spark Open RAN experiments. Energy-efficiency goals align with cloud consolidation, giving European carriers strategic imperatives to modernize networks. Middle East and Africa and Latin America show rising adoption curves fueled by smart-city initiatives, fintech penetration, and mobile-first demographics, though regulatory gaps and skills shortages temper near-term scale.

List of Companies Covered in this Report:

- ATandT Inc.

- Verizon Communications Inc.

- BT Group plc

- Deutsche Telekom AG

- NTT Communications Corp.

- China Telecommunications Corp.

- Telstra Corp. Ltd

- Telefonaktiebolaget LM Ericsson

- CenturyLink (Lumen Technologies)

- Singapore Telecommunications Ltd

- Telus Corp.

- Swisscom AG

- Amazon Web Services

- Microsoft Azure

- Google Cloud

- IBM Cloud

- Oracle Communications Cloud

- Huawei Cloud

- VMware (Telco Cloud Platform)

- Cisco Systems (Telco Cloud)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support